National mortgage news are keeping a scorecard of lenders going under. So far, about 14 percent of the market has disappeared (measured as the last time each lender filed non-prime or prime origination figures with National Mortgage News). Most of the decline is due to New Century, who pulled down around 8 percent of the market.

Meanwhile, the mortgage implode-o-meter keeps rising remorselessly. Today, the reading is 45 lenders down, out and heading for bankruptcy.

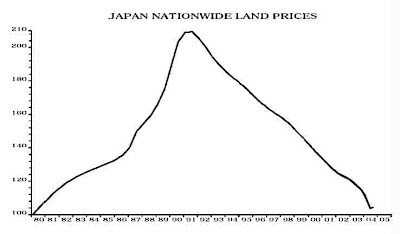

Deflation is not yet beaten in Japan. After ten months of mild inflation, consumer prices fell 0.2 percent in February. The data was particularly bad news for the Japanese central bank, who had been trying to raise interest rates and after several years of free credit, restore monetary policy to something closer to normality. Unfortunately, February’s data suggests that the recent interest rates hike was premature.

Japan continues to act as a warning to others about the dangers of speculative bubbles. The long cold winter of deflation followed on from an extraordinary asset bubble from the late 1980s. Speculation was quickly followed by a recession, a banking crisis and higher unemployment. The government’s repeated attempts to kick start the economy with higher fiscal expenditure have largely failed and led to rising public sector indebtedness.

The housing market data just gets worse. According to a housing index released by Standard & Poor's, prices of single-family homes across the nation depreciated in January compared to a year ago. Furthermore, the decline was the worst in more than 13 years.

The S&P/Case-Shiller composite index showed a drop of 0.7 percent from a year ago in the price of a single-family home based on existing homes tracked over time in 10 metropolitan markets.

Labels:

Today, readers were confronted with the Post's "Housing outlook: 2007". The newspaper is still at it, spinning out feel-good stories for realtors, despite the fact that the market is crashing in flames.

Take for example the article A Buyer's Market? Lenders Permitting. It is highly representative of the kind of rubbish for which the Post is famous. Rather can speak the truth and say that the market is collapsing, and that it is unlikely to recover for years, this is what the newspaper passes off as analysis:

"Once upon a time, would-be home buyers had to outbid each other and forgo inspections to get the place of their dreams. Now, sellers are the ones making concessions. "The buyers are in the driver's seat," said John Eric, a real estate agent with Long & Foster in Arlington.

But not completely. The real estate boom that ended in 2005 was driven partly by lenders' willingness to give money to people with blemished credit or with no money for down payments. Nontraditional loans, such as adjustable-rate mortgages with low introductory interest rates that increased dramatically after two or three years, became popular. With foreclosures now at a record high, banks are once again getting picky. "It's not just a buyer's market," said Leon Bailey, a real estate agent at Exit Powerhouse in Prince George's County. "It's a buyers-with-great-credit market."

Think for a moment about supply and demand. On the supply side, Washington is flooded with overpriced and largely unsellable housing inventory. Moreover, there is a glut of half constructed condos, waiting to pour onto the market. More supply means inevitably lower prices. It may take some time for sellers to understand this reality. There may be a lot of denial out there. But, more supply means lower prices.

It is true that lenders are now scared witless by sub prime defaults. It is also true that mortgage lenders will be much more reluctant to extend loans to people who don't have the capacity to repay them. However, that is a demand side issue. Less financing means less demand, which means lower prices.

So lets summarize for the benefit of all economically illiterate real estate journalists out there. Greater supply means lower prices; less financing means less demand, which in turn means lower prices.

So, if you are a buyer, in the sense that you have the financial capacity to buy a home, the collapse of the sub prime market means that it really is a buyers market. In contrast, if you are a recidivistic credit-crippled debt defaulter, yes, it will be much harder for you to buy that overpriced POS in Manassas, or the converted crack house in SE DC.

If the Post wants to regain its credibility, it has to stop quoting self-interested realtors. It needs to start telling the truth. The truth is simple enough to understand, just think about supply and demand, and it will follow like water flowing from a tap.

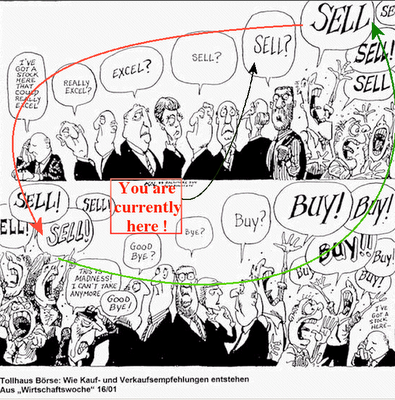

Today's housing market problems gave plenty of warning. Since the summer of 2005, real estate indicators everywhere had been flashing red. Inventory, sales, new home incentives were all telling the same story. The market had peaked and it was going to crash.

Today's housing market problems gave plenty of warning. Since the summer of 2005, real estate indicators everywhere had been flashing red. Inventory, sales, new home incentives were all telling the same story. The market had peaked and it was going to crash.

For example, take a look at just one indicator - KB homes, and in particular, its share price. In early summer 2005, the stock was trading at around $84; three months later it was down at $66. Although there was a temporary rebound during the winter of 2005, thereafter it has traded at around half of what it was during those heady days of summer.

Back then, smart investors knew that the housing bubble was over. Prices were just too far out of whack with reality. The KB homes share price reflected that unsustainability. Since everyone with an Internet connection had access to KBH data, it should not have been too difficult to see where things were going.

Of course, it did not quite happen that way. People looked at the rising housing inventory, declining sales and rising interest rates and somehow could not bring themselves to admit that the market had topped out. Denial and delusion are essential ingredients to any financial catastrophe, and America had both in abundance.

Up until a few weeks ago, many people still believed that the housing slowdown was only temporary. It has taken a 5 percent mortgage delinquency rate and the disappearance of 40 or so sub prime lenders before America as a whole woke up and understand that there was a crisis.

What about KB homes today? What is it telling us about the future for US housing? Well, the recent numbers are grim. The company just reported numbers for the first quarter. Compared to the same period last year, revenues are down 20 percent; net income fell from $173 million to $27.5 million; while orders fell by 12 percent. The only ray of sunshine comes from their cancellation rate, which improved slightly compared to the fourth quarter of last year.

Chief Executive Jeffrey Mezger suggested that "it is hard to predict when the housing markets will stabilize". Perhaps Mezger should try thinking about it a little harder. If he did bother to think, two somewhat related problems would give Mezger sleepless nights. Thinking on a little further, he would understand that the market will not stabilise any time soon.

First, the recent rise in mortgage delinquency and foreclosure rates, will mean distressed sales at knock down prices. In turn, this will undermine KB homes revenue growth potential. Second, the sub prime fiasco will lead to tighter lending standards, drying up housing demand.

KB homes are looking at nasty double-dip; increased supply of unwanted houses, lower demand due to fearful mortgage lenders, this means only one thing, lower sales volumes at lower prices. Since 2005, the share price has implicitly priced in these problems. The share price was flashing red, telling us that the housing bubble is over. Take heed, it is still flashing red today, and it is telling us that the collapse has only just begun.

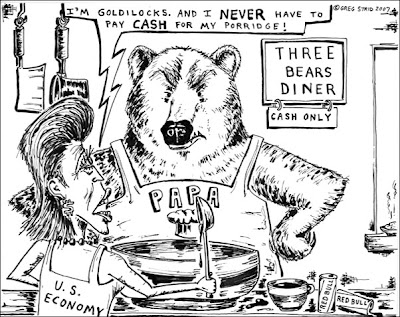

"The US central bank has yet to develop an exit strategy from the multi-bubble syndrome that the Fed, in its zeal for inflation targeting, has spawned.

Moreover, as one bubble begets another, excess asset appreciation has become a substitute for income-based saving — forcing the US to import surplus saving from abroad in order to sustain economic growth.

And, of course, the only way America can attract that capital is by running a massive current-account deficit. In other words, not only has the Fed’s approach given rise to a seemingly endless string of asset bubbles, but it has also played a major role in fostering global imbalances."

From Stephen Roach, Economist at Morgan Stanley, May 23, 2006

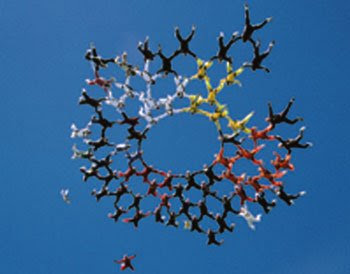

A brilliant youtube movie. It says it all.

What have we done to ourselves? What have we done to our country?

Labels:

The Japanese property bubble is now just a horrible memory, softened by the passing of time. At the height of the bubble, the land beneath the Imperial Palace in Tokyo was supposedly worth more than the entire state of California. In 1989, prices were highest in Tokyo's Ginza district, where land was changing hands for over US$1.5 million per square meter ($139,000 per square foot). However, by 2004, prime "A" property in Tokyo's financial districts were less than 1/100th of their peak. Things were a little better for Tokyo's residential homes, they were worth 1/10th of their peak valuations.

There is one much less commented upon aspect of the Japanese real estate crash - its speed, or lack of it. It was slow, real slow, like watching paint dry. It took years of painful gradual downward price adjustment. Disbelief was the real driver of the crash. No one in Japan wanted to believe that land had become so overvalued.

There was no comfort in this lack of energy. The subsequent damage to the Japanese economy was enormous. The ten years after the real estate peak are now known in Japan as the lost decade. Furthermore, the economy over there still has a long way to go before recovery is assured. Government indebtedness increased dramatically during the last decade, and it is a problem that will come back to haunt the Japanese for decades to come.

Roger Cole, director of banking supervision and regulation, told the Senate today, that the Fed "could have done more sooner" to anticipate a subprime market downturn.

Despite this limited admission of guilt, complacency still rules at the nation’s banking regulator. Mr. Cole does not believe that the problems of the sub-prime sector will spill over to the wider mortgage market or the banking sector.

In an impressive performance, Senator Christopher Dodd said "Our nation's financial regulators were supposed to be cops on the beat yet they were spectators for far too long," Another Senator warned of a "tsunami of foreclosures" while another complained that a "sort of frenzy gripped the markets. Many brokers and lenders started selling these complicated mortgages to lower-income borrowers, many with less than perfect credit."

For the sake of the country, let us all hope that Roger Cole is right. Some of us are old enough to remember the S&L disaster. Banking crises are amongst the ugliest economic disasters that can befall a country. Typically, such crises are followed by deep and sustained recessions, unemployment and misery.

Unfortunately, the Fed’s performance up to this point should make us fearful. It has been obvious since at least 2003 that lending standards have deteroriated, and they did nothing about it. It is late, and for some subprime borrowers, it is too late, but the Fed should immediately tighten lending standards. It should limit the use of exotic loans such as interest-only loans, ARMs and no-doc mortgages. These actions would help restore confidence in the Fed’s capacity to regulate the market, It will begin to restore confidence in the nation’s financial regulator.

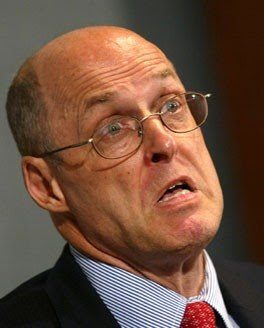

There are two possible interpretations of U.S. Treasury Secretary Henry Paulson's recent comments about the US economy. Neither of them are reassuring. Either Paulson is crapping himself with fear but trying to hide it or he is just plain complacent.

There are two possible interpretations of U.S. Treasury Secretary Henry Paulson's recent comments about the US economy. Neither of them are reassuring. Either Paulson is crapping himself with fear but trying to hide it or he is just plain complacent.

The bad news from the housing market is coming in so fast that it is hard to keep up with it. Here are just a few of the stories that have come through in the last day or so:

Foreclosures at an all time high - According to the Mortgage Bankers Association's most recent data, the proportion of mortgages in the initial stages of foreclosure during the fourth quarter of last year hit its highest in the 37-year history of the association's survey.

Lending conditions are tightening - According to the Federal Reserve's most recent Senior Loan Officers Survey, which the end of last year, domestic banks reported tightening standards on all residential mortgages.

Bankers fear deteriorating asset quality - About 45 percent of bank loan officers in the Fed survey said they expect a deterioration in the quality of the loans, ranging from loans for business investment to commercial real estate loans.

The bubble has to be over when Congress starts to get involved.

The bubble has to be over when Congress starts to get involved.

Connecticut Democrat Christopher Dodd – Chairman of the Senate Banking Committee - would like to ask a few questions to the Fed and other agencies. He was certainly onto something when he said there was “a pattern of neglect by federal bank regulators (that) precipitated the subprime mortgage crisis that could cause 2.2 million homeowners to lose their homes''. However, this “pattern of neglect” has been obvious for several years. It is pity that he did not identify this “pattern” sooner. He might have done something about it, like insist on effective banking regulation,

Meanwhile, Massachusetts Democratic Rep. Barney Frank is targeting late 2007 for passage of a bill to curtail predatory lending like that seen behind the widening mortgage market crunch.

Both initiatives are welcome, but sadly, they are way too late to prevent the unfolding subprime crisis.

Now comes the clean-up. It won't be long before the subprime crisis will fade into the background. A new, politically more explosive, default problem is about to hit the mainstream mortgage market. Soon, the banking system as a whole will be under stress. There is only one organisation with a check book big enough to sort the mess out - Uncle Sam.

Get ready for the biggest taxpayer financed banking bail-out in history.

The world is drowning in personal debt. This story from Bloombergs illustrates just how serious the situation has become:

The world is drowning in personal debt. This story from Bloombergs illustrates just how serious the situation has become:

"Deng Yijun, a cargo freight agency manager in Shanghai, faced a dilemma last December. “I needed a car, but I didn't want to use up my savings as the stock market was booming,'' she says. “So I used credit cards.''

Deng, 32, was eyeing a Ford Focus that cost about 200,000 yuan ($25,815), roughly equal to her savings. Maxing out three cards, she put 140,000 yuan on plastic and gained 56 days of interest-free credit. She paid the rest herself. Most of her remaining cash went into stocks, including Sichuan Swellfun Co. - a distiller whose share price more than tripled in the past year.

Deng says she was able to buy the car for three times her annual salary and purchase stocks after card issuers Bank of Shanghai, China Merchants Bank Co. and China Construction Bank Corp. gave her credit over the phone."

Think for a moment about the implied risks; Deng's personal net worth; and lending standards in Chinese banks.

Deng starts with sufficient savings to buy this car and be debt free. However, she avoids the safe option and entangles herself in high levels of personal debt in order to maintain her over-inflated and risky investments. She would be well advised to sell her shares and pay down her debt. However, those rising stock prices are just too tempting; greed wins over financial prudence.

So she goes into debt, and she isn't thinking small. The debt to income ratio implied by this transaction is on the high side. After some arithmetic, it is clear that Deng has credit card debt equivalent to 2.1 times annual income.

The interest payments will take up a large chunk of Deng’s disposable income, because interest rates on credit cards are always extortionate. Therefore, she has to be anticipating that the return on her equity portfolio is higher than the interest payments on her credit cards.

Furthermore, Deng’s personal balance sheet looks decidedly risky. On the asset side, she has a car, which is always a depreciating asset, along with some overvalued Chinese equity. It would only take an unfortunate collusion in the rush hour and a substantial correction in the stock market, and poor Deng would be seriously upside down. In other words, she would be all liabilities and no assets.

In sum, there is a high probability that Deng will default on this debt. If there are enough Deng's out there in China, then the banks that own that credit card debt have some serious issues to resolve.

But what about the banks that allowed Deng to open herself up to these massive risks? They allowed Deng to accumulate such an enormous debt simply by talking to her on the phone. At the risk of understatement, lending standards do seem to be a little lax in China at the moment.

Unfortunately, Deng is a worldwide phenomenon. The names might change, and the transactions might be different, but across the planet, ordinary people are being encouraged to take on huge amounts of debt that they can barely service. For the most part, this debt is financing over-priced real estate. However, it is also financing unsustainable levels of consumption.

Unfortunately, this spend fest can not continue indefinitely. The easy way out of this mess would be for central banks to hike interest rates. It will be painful, and too late to save Deng, but at least it would discourage other people from being buried in debt.

However, central banks are always cowards. They will wait, and wait until it is too late. It will not be a hike in interest rates that will stem the flood of toxic debt; it will be a rise in defaults. Suddenly, commercial banks will remember that there is such a thing as credit risk, they will stop financing the Dengs of this world. There will be no more Ford Fiestas financed with credit cards; consumption will crash and the world will fall into a recession.

The subprime crash claimed another victim. On Tuesday, California based People's Choice Home Loan., filed for Chapter 11 bankruptcy protection from creditors. According to court documents, the company listed more than $100 million of assets and employed around 1,100 people nationwide.

Many Americans are depending on their home for security in their retirement. But how well has real estate performed as a long term savings vehicle? As a recent Fidelity Research Institute Report points out, historically, real estate returns have been rather poor.

Many Americans are depending on their home for security in their retirement. But how well has real estate performed as a long term savings vehicle? As a recent Fidelity Research Institute Report points out, historically, real estate returns have been rather poor.

The Fidelity researchers examined long term real returns going back all the way to 1835. They then calculated the average returns over 5, 10, 20 and 30 years. They found that real estate performs worse than stocks, bonds and treasury bills. In fact, real estate closely tracks the real income growth. As such, if property prices are growing faster than income growth, it is a sure bet that property is overvalued.

If real estate offers such poor returns, then why is there is misconception that it is such a good investment? There are a couple of reasons for the real estate super-returns myth. First, people often just look at capital gains and largely ignore other real estate related costs; for example taxes, repairs and maintenance. Second, people often under-estimate the interest costs of long term debt; a 30 year loan does involve a lot of interest payments. Finally, people often confuse real and nominal growth. Six percent annual capital gains might seem like a healthy return, but if inflation is growing at 5 percent, then it is obviously a lot less impressive.

Certainly, during the last five years, returns were higher than historical averages. However, prices are now definitely heading south. If you haven't sold and started renting, stop counting up the retirement resources embedded in the value of your home. Insofar as that equity windfall existed, it is about to slip away.

More bad news for New Century Financial. The struggling subprime lender is edging ever closer to bankruptcy. On Tuesday, the company admitted that that it can no longer sell mortgage loans to Fannie Mae or act as a primary servicer of mortgage loans.

In a filing with the U.S. Securities and Exchange , New Century said that Fannie Mae terminated a mortgage selling and servicing contract with the beleagured subprime lender, citing alleged breaches of contract.

Meanwhile, New York's banking department suspended the banking license of New Century's Home123 affiliate for up to 30 days.

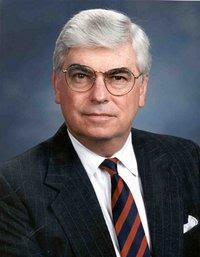

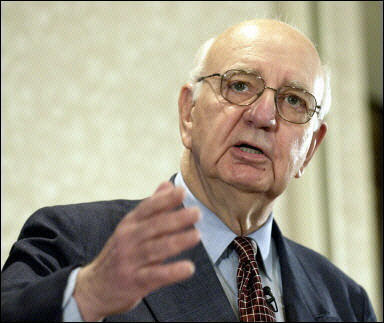

Paul Volker was Fed Chairman from 1979 to 1987. Almost singlehandedly, he brought inflation down from 13.5% in 1981 to 3.2% by 1983. While he was running the Fed, there were no real estate bubbles, sub prime collapses nor dot.com ponzi schemes.

Paul Volker was Fed Chairman from 1979 to 1987. Almost singlehandedly, he brought inflation down from 13.5% in 1981 to 3.2% by 1983. While he was running the Fed, there were no real estate bubbles, sub prime collapses nor dot.com ponzi schemes.

He did what he had to do. He pushed up interest rates and he kept them there until he had restored confidence in the dollar.

Oh Paul, where are you when your country needs you?

Central bank governor Zhou Xiaochuan said in an interview published Tuesday that China would stop stockpiling foreign exchange reserves. "Many people say that foreign exchange reserves in China are (already) large enough,'' Zhou told the Emerging Markets magazine. We do not intend to go further and accumulate reserves," he said.

Central bank governor Zhou Xiaochuan said in an interview published Tuesday that China would stop stockpiling foreign exchange reserves. "Many people say that foreign exchange reserves in China are (already) large enough,'' Zhou told the Emerging Markets magazine. We do not intend to go further and accumulate reserves," he said.

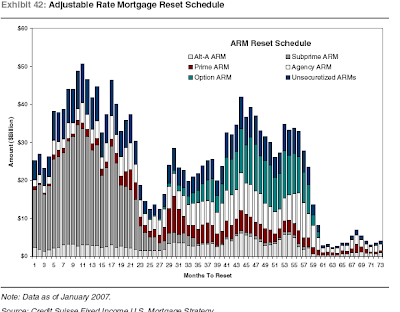

It is the subprime borrowers that dies first. For the next two years, every month, hundreds of millions of subprime mortgage debt will reset, pushing the hapless borrowers into delinquency. This has already begun to happen. Currently, 13 percent of sub prime lenders are behind in their payments. Judging by this chart, we haven't begun to see the worst of this particular financial disaster

Once that wave of default and foreclosure slips away, another equally devastating blow will hit the housing market. Servicing costs for prime ARMs, Alt-A, and option ARMs all begin to increase. By then, the average homeowner will look upon the housing bubble like an old man looks upon this first love - a sweet and distant memory.

The housing market will have no time to recover. This disaster will continue for at least another 5 years. Only then, will the market have a chance to breath again.

This chart first appeared on the OC-fliptrack blog. It is first rate source housing bubble developments Orange County housing disaster.

Throughout the United States, nearly 5 percent of homeowners are delinquent on their mortgage payments.

For subprime borrowers, the delinquency rate has hit nearly 14 percent.

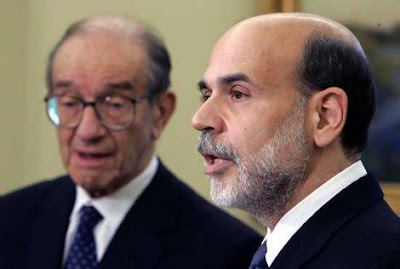

Who were guilty men and women that created the great housing catastrophe that wrecked the US economy in 2007-8. Today, we expose the guilty.

Who were guilty men and women that created the great housing catastrophe that wrecked the US economy in 2007-8. Today, we expose the guilty.

The first in the dock must be the Fed and in particular Alan Greenspan. Reducing short-term interest rates to just one percent was an almost criminal act of inflationary irresponsibility. This wild deed laid the basis for the credit boom that fired up the inferno.

The second indictment must go to financial market regulators. These men and women permited lending standards to become so lax that anyone, regardless of their credit history, could obtain a mortgage. They ignored the dangers of unfettered financial innovation. They failed to prevent highly specialized products - such as the interest only mortgage and adjustable rate mortgages - from being mis-used and abused by mortgage lenders.

No, the lenders do not escape judgement. They took advantage of the weak-willed regulators. They recklessly sold mortgage products to people who did not understand the risks. Through misleading advertizements, they sought out the vulnerable and when they found them, they defrauded and deceived them.

The next indictments go out to the realtors and appraisers. Despite understanding the long run dynamics of local housing markets, they conspired to overvalue and inflate property prices. Through the callous engineering of bidding wars, they spread fear among first time buyers. They were the dark magicians that conjured lies about housing shortages. They promised untold riches through real estate investing. It was never about serving their client; it was always about the commission.

Finally, we have the media. Local newspapers, across this country, talked up the bubble. They accentuated the fear, and confirmed the lies and distortions spouted by realtors. Rather than seek out the truth, they searched for ad revenues, and the realtors were willing to buy them off.

Now, it is all over. Prices are coming down; markets are crashing. There no lies left to tell. There are no more distortions can disemble the truth. All that is left is foreclosure, despair and ruin.

Nevertheless, should the ordinary American also bear some responsibility for this calamity? Did not greed also play its part?

Greed is an intrinsic part of human nature. Society needs to create institutional constraints to protect us all from our own evil nature. We ensure that protection by creating institutions and by entrusting individuals with responsibility. We ask central bankers to protect the value of our national currency. We require our financial regulators to ensure the viability of our financial enterprises. We demand honesty and integrity from mortgage lenders. We expect realtors and appraisers to work in the interest of their clients. We hope that the media will always seek out the truth.

Over the last five years, institutions failed and individuals evaded their responsibilities. Now, there is a terrible price to pay for that failure.

Despite earlier interest rate hikes, China's economy just keeps on growing. Last year, it expanded 10.7 percent. This extraordinary economic growth has fueled a remarkable property bubble.

The red kingdom has perhaps the strangest property bubble in history. In principle, a bubble should be impossible; the state owns all the land. Moreover, there is no effective legislation guaranteeing private property. Instead, there is a leasing bubble. The state issues leases, normally lasting for 70 years, and which gives the owner the exclusive rate to use the property. However, the leases are transferable and this creates the basis of the Chinese bubble.

The leasing system has been one of the cornerstones of the Chinese economic miracle. Since all land is state owned, the Chinese government can determine land usage without any annoying planning regulations. Therefore, when a new foreign investor needs a factory, the bulldozers move the locals out and up goes the shiny new building. A few little envelopes here and there and things can move real quick.

But what happens when the leases expire? Now that is a tricky question. No one really knows for sure. It is not as if there is a functioning legal system that can defend property rights.

Despite these legal difficulties, investors have bought up these leases with scant regard for the future. Prices have shot up, partly fueled by easy credit. Now, the central bank is trying to calm things down. However, it is going to take more than one marginal hike to calm the crazy Chinese non-property bubble.

The sub prime meltdown is starting to look like a re-run of the dot.com debacle.

The sub prime meltdown is starting to look like a re-run of the dot.com debacle.

First, we heard the hyped up story that “things are different this time”. We were supposed to believe that people with poor credit histories were capable of repaying 100 percent loans on over priced houses over thirty years. It is a claim that sounds about as plausible as the one we heard back in 2001; that the stock of companies without cash flow could keep rising forever. Then, we saw the bust. First comes declining house prices, followed by a wave of bankruptcies. Finally, financial market regulators start to examine the dubious role of the Wall Street Banks in fermenting the bubble.

The Massachusetts' securities regulator is suspicious about the now defunct sub prime lender – New Century. This week, the regulator issued subpoenas to two Wall Street investment banks – UBS securities and Bear Stearns - as part of an investigation into whether the firms' research analysis ignored sub prime lenders' mounting financial problems.

Despite the mounting and well-publicized problems of defaults and delinquencies, the investment banks continued to push out feel good outlooks on New Century. Even when New Century started to sink and could not get financing, the investment analysts were still telling anyone who listened that New Century was in great shape. For example, on March 1, Bear Stern’s upgraded New Century’s stock from “under perform” to “peer perform”. Meanwhile, on February 22, UBS upgraded New Century to a “neutral 2” rating, and advised investors to hold the stock.

Trading in New century stopped on March 12.

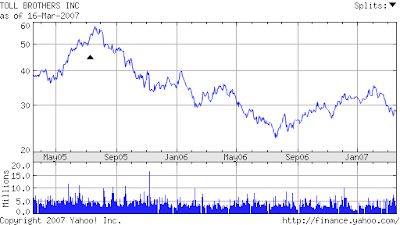

Last year, CEO Robert Toll – who runs the luxury home construction firm Toll brothers - took home a staggering $21.8 million pay package. This extraordinary amount also included a performance related $17.5 million bonus.

Last year, CEO Robert Toll – who runs the luxury home construction firm Toll brothers - took home a staggering $21.8 million pay package. This extraordinary amount also included a performance related $17.5 million bonus.

If only the Robert Toll could inflate the share price as fast as his compensation. Since the summer of 2005, the share price has fallen from around $60 to under $30 (see the chart above). So as the shareholders have become poorer, Bob “the Builder” Toll has been pulling out the cash from the company.

Former Federal Reserve Chairman Alan Greenspan is again trying to spook financial markets. On Thursday, he turned his attention to the sub prime market. He declared that there was a risk that rising defaults in sub prime mortgage could spill over into other sectors. Greenspan conceded that it was "hard to find any such evidence" about spillovers from housing yet, but he added, "You can't take 10 percent out of mortgage originations without some impact." Greenspan felt that the downturn in U.S. housing markets stemmed more from high housing prices than from a decline in mortgage quality.

Former Federal Reserve Chairman Alan Greenspan is again trying to spook financial markets. On Thursday, he turned his attention to the sub prime market. He declared that there was a risk that rising defaults in sub prime mortgage could spill over into other sectors. Greenspan conceded that it was "hard to find any such evidence" about spillovers from housing yet, but he added, "You can't take 10 percent out of mortgage originations without some impact." Greenspan felt that the downturn in U.S. housing markets stemmed more from high housing prices than from a decline in mortgage quality.

For a few weeks now, Greenspan has been pouring out doom and gloom about the US economy. Previously, he announced that a recession by the end of this year was possible, undermining the soothing words of his successor – Ben Bernanke – who is busy talking the US economy up. Sadly, Greenspan does appear to be right. Increasingly, US macroeconomic data is pointing towards a major slowdown in activity.

However, Greenspan is not prepared to take any responsibility for his role in the deteriorating economic prospects for the US economy. He was the Fed Chairman when interest rates were slashed to just one percent. He was in charge when housing prices soared, and sub prime lenders were prepared to borrow money to anyone who could show a beating pulse. He was the man that unleashed the inflationary beast and left it to Bernanke to tie it down with a sustained hike in interest rates.

Ultimately, Greenspan is proof that one’s reputation is really just a matter of timing; get out when things are good, and everyone thinks you are a star, but if you hang on when the ship is sinking, then everyone associates you with failure.

The US economy is still a world-beater, at least when it comes to running up external deficits. Last year, the US imported $856 billion more than it exported. The current account now stands at 6.5 percent of GDP and it is 8 percent higher than it was in 2005. The US current account is definitely on a roll; it is the fifth straight year that the deficit increased.

So how can the US spend more than it earns? Borrowing from abroad; last year the US borrowed an average of $2 billion per day.

To cut or not to cut, that is the question. Well, that question just got a lot harder for the Fed. The extended interest rate hike has not yet killed off inflationary pressures in the US economy. According to the Labor Department, producer prices increased by 1.3 percent in February compared to the previous month. Food prices were up almost 2 percent, while energy prices increased 3.5 percent.

To cut or not to cut, that is the question. Well, that question just got a lot harder for the Fed. The extended interest rate hike has not yet killed off inflationary pressures in the US economy. According to the Labor Department, producer prices increased by 1.3 percent in February compared to the previous month. Food prices were up almost 2 percent, while energy prices increased 3.5 percent.

Overall, the Fed finds itself in a bad place. As today’s data suggests, inflationary pressures remain strong, necessitating continued high interest rates. On the other hand, the housing prices are falling, foreclosure rates are accelerating while subprime lenders are falling like flies. The housing market needs an interest rate cut real bad.

In the past, the maxim has been “central banks should target inflation and not asset prices”. In practice, the Fed was happy to let asset prices – such as stocks and housing - bubble into the stratosphere. However, it has always been more uncomfortable with declining asset prices. When the dot.com bubble threatened to bring on a recession, the Fed hastily cut interest rates. Unfortunately, today the inflationary environment is much less benign than in 2001. Any attempt to rescue the housing market will only serve to maintain the already elevated levels of inflation.

There are homes for sale everywhere, and not a buyer in sight.

There are homes for sale everywhere, and not a buyer in sight.

In January, new homes completed and available for sale reached a record high of 175,000. According to the Census Bureau, new home supply is up 47 percent from a year earlier.

Meanwhile, the number of existing homes for sale was up 23 percent to 3.5 million.

Labels:

Does this sound familiar; the owner of a subprime lender delays filing its quarterly results with regulators? This time it is Option One Mortgage Corp. Its owners H&R Block Inc, need more time as it writes off assets. Rising defaults has forced the company to re-evalue its balance sheet. The stock fell 43 cents, or 2.1 percent, to $19.62. Sounds a lot like New Century, the subprime lender that went bust earlier this week.

GMAC's Residential Capital is also adding to the sense of panic in the subprime mortgage sector. The company said it has "struggled with a slower pace of loan originations and a further erosion in its subprime business."

Meanwhile, the mortgage lender implode-O-Meter is still rising. Since December, 36 subprime mortgage lenders have gone to the wall.

Also, check out America's top ten foreclosure markets.

Labels:

Angelo Mozilo - CEO and Chairman of Countrywide Financial Corp. - seems to have lost faith in the share price of company. He has been dumping stock as if the share price were about to crash. For details of his various share sales, just click here. Isn't SEC disclosure a wonderful thing.

Since February, the price is slippin' south. It has fallen from around $45 a share to $35 a share.

Does Angelo know something that the ordinary shareholders don't?

The Mortgage Bankers Association just released quarter 4 data for home payments. It is ugly out there. One in 20 US mortgages are now in delinquency, while 13.4 percent of sub prime borrowers are behind in their payments. The foreclosure rate is now 0.54 percent and rising fast.

The Mortgage Bankers Association just released quarter 4 data for home payments. It is ugly out there. One in 20 US mortgages are now in delinquency, while 13.4 percent of sub prime borrowers are behind in their payments. The foreclosure rate is now 0.54 percent and rising fast.

Meanwhile, the National Association of Realtors said that a recovery in the nation's housing market is "likely" this year. They confidently predict that the median new-home price should grow 1.7 percent in 2007 and 3 percent next year.

Rising prices, coupled with rising foreclosures and delinquencies; that sounds like a prediction grounded on solid evidence.

When will Congress start to get serious about trade policy with China? Today, the Chinese authorities reported their trade surplus for the first two months was $39.6 billion, more than triple the same period last year. Exports gained 52 percent in February, the biggest jump since 1995. Imports climbed 13 percent.

When will Congress start to get serious about trade policy with China? Today, the Chinese authorities reported their trade surplus for the first two months was $39.6 billion, more than triple the same period last year. Exports gained 52 percent in February, the biggest jump since 1995. Imports climbed 13 percent.

The Chinese central bank have kept the Yuan low, and made their exports very cheap. This policy helps industrialise and strengthen China and facilitiatse its expansionist aspirations. However, it is also exploitative. Chinese wages are kept artificially low. In effect, poorly paid chinese workers subsidize the unwarranted and slovenly lifestyles of flabby Americans.

The under-valued exchange rate pumps cheap goods in to the US and destroys our manufacturing base. This policy has led to China accumulating foreign-currency reserves amounting to a record $1 trillion, a fifth of the world's total. The stock of reserves is now so big that it has become useless. Any attempt to reduce their holdings of US dollars would destabilise foreign exchange markets, leading to a run on the dollar and a sudden and uncontrollable appreciation of the Yuan.

Nevertheless, the Chinese keep talking up a change. China's central bank Governor Zhou Xiaochuan today pledged to accelerate the drive to a market-led financial system. He also pledged to loosen controls on interest rates and begin to bail out loss-making state banks. Fu Ziying, assistant minister of commerce also promised to cut some import tariffs and export rebates. Apparently, these measures are supposed to pave the way for a more flexible yuan, and fend off calls in Congress for trade sanctions.

The message from these numbers to Congress is clear; give the US manufacturers some protection.

New Century Financial is sinking fast. It may well be that by the end of this week it will have slipped into bankruptcy.

Today, trading in New Century shares was suspended. The second largest US subprime mortgage lender reported to the SEC that its banks had cut off the credit lines. The company also reported that some lenders had demanded that it accelerate its obligations to buy back outstanding mortgage loans financed under various lending agreements. Moreover, the company said that if all its creditors decided to pursue a similar course of action, then New Century would have to find at least $8.4 billion of cash. Mmmm, $8.4 billion – now that sounds like a pretty big stack of cash to pony up in just a week.

There was a time, and it was not so long ago, that New Century shares traded at $66, giving a market cap of $3.7 billion. How long ago you ask: just three short years ago. Just before the shares were pulled from the market, New Century was worth just $178 million. Many bloggers have drawn some comparisions between today’s subprime mortgage market and the tech bubble. At the risk of repeating a well-worn point, the New Century numbers look an awful lot like dot.com.

This is the beginning of end, my friends. Hold on; where New Century walks today, others will follow.

Today, Bloomberg provided the most disturbing scenario yet for the US housing market, suggesting that as many as 1.5 million Americans might lose their homes to foreclosure, a 100,000 housing related jobs could disappear and that as many as 100 subprime lenders might go into bankruptcy.

Certainly, the latter prediction is well on its way to becoming a reality. So far, around 33 subprime mortgage brokers have ceased trading. The foreclosure rate is also on a rocket-like trajectory. As for job losses, there does seem to be rather a lot of idle and under-employed realtors out there.

One of the UK’s largest house builder today predicted that the UK housing market will remain strong in 2007. Bovis Homes Chairman Tim Melville-Ross said "Looking ahead, it is anticipated that the under-supply of new housing relative to new household generation will continue," said Mr Melville-Ross. "When this is allied to household growth, driven by demographic and societal changes, that is in excess of supply, then robust market fundamentals remain in place."

One of the UK’s largest house builder today predicted that the UK housing market will remain strong in 2007. Bovis Homes Chairman Tim Melville-Ross said "Looking ahead, it is anticipated that the under-supply of new housing relative to new household generation will continue," said Mr Melville-Ross. "When this is allied to household growth, driven by demographic and societal changes, that is in excess of supply, then robust market fundamentals remain in place."

Bovis certainly had a good year. Its pre-tax profits for 2006 rose by 13.7 percent to £132m. Revenues rose 14.6% to £597.3m, on the back of an unsustainable housing bubble in the UK. Extrapolating from the past, the future just looks better and better. Profits will be piled upon profits as the luckless British public pay out ever increasing proportions of their income servicing mortgage related debt.

The UK property market is probably the most overvalued in the world. Last year, property prices increased by over 10 percent while personal incomes increased by just 3.7 percent. The bubble is fueled by the usual mix of lax lending standards, and delusions about eternally increasing prices. The local mortgage lenders are offering products that would make New Century, over here in the US, look like a prudent and respectable financial institution. In some parts of the UK, housing loans based on a ratio of 5 times salary are the norm. Say good-bye to the “no money down” loan and say hello to the 105 percent loan. Mortgage lenders are prepared to extend loans that starts the new homeowner out with at least 5 percent of negative equity.

However, there is a storm cloud gathering that might yet rain on Bovis’s brilliant future. Inflationary pressures in the UK are building up, and interest rates are now creeping northward. Here, the experience of the US provides an invaluable lesson, and it is a simple one. It doesn’t take a massive hike in interest rates to generate a collapsing housing market. All you need is over-extended borrowers, lax lending standards and the sudden realisation that house prices can not outstrip income growth forever. After that, it is just pain, misery and despair.

What a difference a year makes - During the last three months, the company lost $57.3 million, or 91 cents a share. During the same period last year, the company turned a profit of $81.43 million, or $1.25 a share.

The past is catching up with the present – The company needs to make one time write-offs; $90 million related to operations in Fort Myers-Cape Coral, Florida, and $8 million in other markets.

No one wants those McMansions anymore – Net contracts for the quarter slipped 23 percent to 2,570, excluding 43 homes in joint ventures. Companywide, cancellations for the first quarter rose to 36 percent of gross contracts from 35 percent in the fourth quarter of 2006.

Incentives and price reductions are now eating into revenues- In the first quarter, revenue was $1.17 billion, down 8.8 percent from revenue of $1.28 billion in the same period a year ago.

The share price is down; way down – After the company reported the dismal first quarter performance, the shares fell 4.1 percent. Analysits were expecting some bad numbers, but the losses exceeded most expectations. More generally, HOV has proved to be a particularly dangerous stock to have in your portfolio. Just 12 months ago, the stock was trading at over $45 a share; now it has slipped below $30.

And how exactly does CEO Ara Hovanian feel about the current market? “Our first quarter is always the slowest seasonal period for new contracts, so it is difficult to get a good feel for the strength of the market and what absorption rate to project for the rest of the year in each of our communities,” he said. “Most of our markets have begun to show signs of stabilization, but we are not yet confident that we have found the bottom of this housing slowdown.”

Labels:

On Friday, Countrywide Financial - the largest U.S. mortgage lender - finally told their brokers to stop offering borrowers no-money-down home loans. From now on, borrowers will have to have at least a 5 percent down payment. Countrywide is the latest lender that tightened borrowing requirements. Washington Mutual and WMC Mortgage have both introduced similar restrictions.

On Friday, Countrywide Financial - the largest U.S. mortgage lender - finally told their brokers to stop offering borrowers no-money-down home loans. From now on, borrowers will have to have at least a 5 percent down payment. Countrywide is the latest lender that tightened borrowing requirements. Washington Mutual and WMC Mortgage have both introduced similar restrictions.

Countrywide is now desperate to improve prudential lending standards. However, this horse bolted a long time ago. The belated attempt to close the barn door will have little practical effect on the rising tide of mortgage defaults.

Like many mortgage lenders, Countrywide spent five years building up a portfolio of high risk loans. Rapidly rising house prices, coupled with stagnant income growth led to many new homebuyers being stretched to the financial limits. Many of these bubblehomes were purchased with adjustable rate mortgages and other exotic and poorly understond financial products. Now that interest rates are adjusting upwards, Countrywide and other lenders are bracing for an avalanche of foreclosures, payments difficulties and defaults.

But why couldn’t Countrywide management see this problem coming? Isn’t obvious that offering 100 percent loans to customers with poor credit histories is about as dumb a thing as a lender can do? Mortgage lending isn’t rocket science. If someone has defaulted on a loan before, it is likely that they will do it again. A guy on a $50,000 salary is going to find it extremely difficult to maintain the payments on a $500,000 condo. And if he has bought five similarly priced condos, with financing provided by five “No doc” loans, then he is very likely to end up in foreclosure if condo prices slump by 5 to 10 percent.

Tightening lending standards signal the absolute and irreversible end of the housing bubble. It will shut off speculative demand. The so called “real estate investors” will no longer have the financing to continue with their ill-judged flippery. It is all over. From here on in, it will a painful story of foreclosures, defaults and mortgage lender bankruptcies.

Unfortunately, US unemployment fell last month. The economy added around 100,000 jobs, reducing the unemployment rate to 4.5 percent, and raising fears that interest rates won’t be cut any time soon.

Unfortunately, US unemployment fell last month. The economy added around 100,000 jobs, reducing the unemployment rate to 4.5 percent, and raising fears that interest rates won’t be cut any time soon.

The lack of an interest rate cut is killing the housing market.

As a consequence, housing sales have declined, leading to a dramatic cut in realtor commissions.

Stocks rose on the bad news, as did the dollar. Meanwhile a separate government report showed that the trade deficit declined marginally in January.

Labels:

With housing inventory already at uncomfortably high rates, it would appear that the subprime mortgage debacle will serve to add a further 500,000 homes to supply.

March 9 (Bloomberg) -- Rising mortgage defaults by subprime borrowers may add more than 500,000 homes to a residential real estate market already beset by slumping prices, according to CreditSights Inc.

In January, 4.09 million new and existing homes were offered for sale, down from 4.43 million in July 2006, the National Association of Realtors and the U.S. Commerce Department said. New homes accounted for 536,000 of the January total, down from a record 573,000 in July.

A five-year housing boom that ended a year ago was fueled in part by the growth of mortgage products marketed to borrowers with poor credit histories. Now, as defaults on subprime loans surge to a seven-year high, more than 20 lenders have closed or sought buyers since the start of 2006. The survivors are raising their lending standards.

"We estimate that the effect of looser lending standards could translate into another 533,000 homes coming onto the market as borrowers default -- an unwelcome phenomenon given the existing supply surplus,'' Sarah Rowin and Frank Lee of bond research firm CreditSights wrote in a March 1 report.

The glut of homes on the market has led potential buyers to hold off purchases on expectations that prices will fall. Tighter lending standards may also hurt the housing recovery as people who could previously qualify for a mortgage can't get one now.

About 10 percent of subprime loans were more than 60 days delinquent or in foreclosure as of Dec. 31, up from 5.4 percent in May 2005, according to data compiled by Friedman Billings Ramsey Group Inc. of Arlington, Virginia. The rate was the highest in seven years, according to the report.

The end for New Century is drawing closer. The sub-prime mortgage lender has stopped making loans. The halt on loans is, at best, a temporary measure. Without new business, the company will be unable to pay wages and other costs. The company’s stock has plunged by almost 90 percent this year, and bankruptcy protection seems to be a matter of days away.

The end for New Century is drawing closer. The sub-prime mortgage lender has stopped making loans. The halt on loans is, at best, a temporary measure. Without new business, the company will be unable to pay wages and other costs. The company’s stock has plunged by almost 90 percent this year, and bankruptcy protection seems to be a matter of days away.

Should the company go bust, it will bring the subprime crisis to an entirely new level. The company is, or should we say, was America’s second largest subprime lender. In 2006, total mortgage production at New Century was $59.8 billion,. It employed more than 7,200 people at the end of 2005.

Bankruptcy is likely to be followed by a criminal investigation. The company disclosed last week that U.S. prosecutors are probing trades in securities that occurred before the company announced Feb. 7 it needed to restate earnings. Investigators also are scrutinizing the company's accounting. New Century said it underestimated costs to buy back loans sold to investors that later went sour.

What has brought New Century to the edge of extinction? The company sold exotic mortgages to people who didn’t understand them and who quickly ran into payments difficulties. Once the default rate started to rise, New Century’s financiers took fright and cut off funding for new business. In a statement, company said it is in talks with lenders and potential partners about refinancing or “other alternatives.” New Century added it can give “no assurances” that efforts to refinance the debts will succeed.

More subprime bankruptcies will follow. The question is how long will it be before the default plague the the subprime panic infects the mainstream banking system.

Here is an easy economic forecast with a high probability of realisation; Venezuela is heading for a calamatious fiscal crisis. It is going to happen the moment that oil prices start to decline. Last year, el jefe and dictator for life – Hugo Chavez – increased public sector expenditure by a staggering 48 percent. Despite the fact that oil prices are at an all time time, oil-producing Venezuela is running fiscal deficit.

Here is an easy economic forecast with a high probability of realisation; Venezuela is heading for a calamatious fiscal crisis. It is going to happen the moment that oil prices start to decline. Last year, el jefe and dictator for life – Hugo Chavez – increased public sector expenditure by a staggering 48 percent. Despite the fact that oil prices are at an all time time, oil-producing Venezuela is running fiscal deficit.

The country's stretched finances should come as no surprise. Chavez spared no effort to win another six-year term in office. His generous social programs helped grease the political machine that handed him the presidentcy chair once more. However, the guy is addicted to public expenditure. His spending continues to rise this year even in the absence of elections. Buying elections can be expensive, and it has become a habit. He carries on with it, even after he has effectively abolished parliament and now rules by decree.

The quasi-communist leader who often rails against the "evils of capitalism" spent a record amount and left a 2.28 trillion bolivar ($1.06 billion) gap in the country's finances even in the face of record oil gains. Soon, he will find out that there is an even greater evil that capitalism; it is called fiscal reality.

The arithmetic of the Venezuelan budget is simple enough. Over 53 percent of revenues come from oil. The price of oil is currently around $55 a barrel. So long as it stays there, he will be OK. If it drops off, he starts to slip into trouble. Nevertheless, the economy is starting to show the strains arising from his extravangence. He has also propelled inflation to 17 percent, making it the highest in Latin America. At the current pace, many expect rising prices to top 20 percent this year.

As we know, inflation always hurts the poor. So what he gives in entitlement programs, he takes back with inflation. Viva la revolution!

Medical costs are one of the fastest rising components of the US CPI. With insurance premiums running out of control, many families can no longer afford effective coverage. So why is health care so expensive?

Doctors will tell you that it is litigation, excessive bureaucracy and paperwork and greedy HMO managements. In contrast medical salaries are rarely mentioned as a potential cause.

Well, there is a blog for every subject on the web, and there is even one just devoted to physician's salaries. It contains some amazing posts. For example, can can anyone resist reading a post entitled "the million dollar surgeon".

However, the most revealing post was called "physicians dominate top 50 highest paid list". According to the Bureau of Labor Statistics, a staggering 9 out of the 10 highest paid jobs on the list were found in the health care industry. Here is the list of shame:

1. Surgeons -- $177,690.

2. Anesthesiologists -- $174,240.

3. Obstetricians and Gynecologists -- $171,810.

4. Orthodontists -- $163,410.

5. Oral and Maxillofacial Surgeons -- $160,660.

6. Internists, General -- $156,550.

7. Psychiatrists -- $146,150.

8. Prosthodontists -- $146,080.

9. Family and General Practitioners -- $140,370.

10. Chief Executives -- $139,810.

Alan Greenspan still hasn’t quite realized that he is no longer in charge of US monetary policy. Rather than seeking a quite retirement, he has chosen to stir up controversy., complicating the job of his successor Ben Bernanke. On Tuesday, he told the Bloomberg news agency that there was a “one-third probability” of a US recession this year. Unfortunately, the former Federal Reserve chairman’s comments doesn’t quite rhyme with the upbeat and optimistic assessment of the US economy made by Helicoptor Ben.

Alan Greenspan still hasn’t quite realized that he is no longer in charge of US monetary policy. Rather than seeking a quite retirement, he has chosen to stir up controversy., complicating the job of his successor Ben Bernanke. On Tuesday, he told the Bloomberg news agency that there was a “one-third probability” of a US recession this year. Unfortunately, the former Federal Reserve chairman’s comments doesn’t quite rhyme with the upbeat and optimistic assessment of the US economy made by Helicoptor Ben.

Mr Greenspan’s latest remarks come a week after he told investors that he thought a US recession this year was “possible”. The earlier comments destabilized financial markets, leading to a global sell off. Somewhat later, and too late to stop the slide in equity prices, Mr Greenspan clarified his statement, declaring he had said that a recession this year was “possible” but not “probable”. Indeed, all things are possible.

When it comes to unsecured debt, the British are the champions of Europe. According to Datamonitor, individuals in the UK have an average of £3,175 ($6,223) unsecured debt, more than double that in the rest of western Europe and now accounts for a third of all personal debt on the continent. Despite these staggering levels of debt, UK banks seem unconcerned about rising levels of personal indebtedness. In recent years, personal bankruptcy in the UK has rocketed (see chart above). Last year, over a 100,000 people entered into Individual Voluntary Arrangements (IVAs) – the British equivalent of personal bankruptcy, forcing lenders to write of £1.4bn of bad debts.

When it comes to unsecured debt, the British are the champions of Europe. According to Datamonitor, individuals in the UK have an average of £3,175 ($6,223) unsecured debt, more than double that in the rest of western Europe and now accounts for a third of all personal debt on the continent. Despite these staggering levels of debt, UK banks seem unconcerned about rising levels of personal indebtedness. In recent years, personal bankruptcy in the UK has rocketed (see chart above). Last year, over a 100,000 people entered into Individual Voluntary Arrangements (IVAs) – the British equivalent of personal bankruptcy, forcing lenders to write of £1.4bn of bad debts.

Meanwhile, the total stock of UK mortgages now stands at over £1 trillion; a figure that has risen by over 24 percent compared to last year. Taking mortgage and unsecured debt together, this means that every man, woman and child in the UK owes an average of £21,000 ($41,660). This rising stock mortgage debt has not been accompanied by a similarly rapid rise in personal income. Moneyfacts, the financial information company, said that on average mortgage payments account for 24 percent of people's pre-tax salary today. In 1996, just 16.5 percent of households' salaries went on mortgage repayments. The situation for first-time property buyers, is even more desperate. Mortgage debt accounts for nearly 27 percent of first-time buyers' salary compared to 18 percent in 1996.

Incomes have not kept pace with housing prices. Between 1996 and 2006 the average income for first-time buyers has nearly doubled from £17,308 ($33,924) to £34,216 ($67,063) while average house prices have soared from £64,692 ($126,796) to £211,453 ($414,448). During the same period, the ratio of house prices to incomes have risen from 3.7 to above 6. Yet despite increasing signs of a massive and bloated bubble, house price inflation shows no signs of relenting. Last year, house prices increased by a staggering 9 percent.

Given that UK residents pay around 40 percent in personal taxes, most people are paying almost a half of their personal incomes on mortgage costs. In such circumstances, it is perhaps not surprising that people have resorted to personal unsecured debt to finance consumption expenditure. Nor is it surprising that an increasing number of debt soaked homeowners have resorted to personal bankruptcy.

New Century - one of America’s largest subprime mortgage lenders – is careering towards bankruptcy. The company’s shares are down almost 70 percent, and languishing somewhere south of $5 a share.

As concerns grow about the financial viability of the company, its creditors are taking fright and cutting credit lines. Bear Stearns analysts reduced their estimated liquidation value to $8 to $9 a share, down from $10 to $11 previously and "expect the stock to trade toward this level as the odds of bankruptcy appear to have increased." Creditor confident was shattered after revelations that the company is under investigation for violating debt covenants with several investors.

After years of fat commission selling exotic loans to desperate homebuyers, mortgage brokers are now waking up to the post-bubble reality. The loan officer forum - an industry notice board - tells a sorry tale. Brokers are finding it hard to make a living as increasing sub prime defaults, falling housing demand and tightening credit standards have led to a collapse in mortgage applications.

The opening post says it all:

"As I sit here felling like I just watched a train wreck, I am trying to comprehend everything we just witnessed. This is my 12th year in real estate so I can tell you it will be fine in the end, but wow what a day. Email after Email from lenders telling us of their guide line changes, and the layoffs. This is a lot to take in. So won't you join me and raise your glass to the end of a great ride, and the beginning of a better one."

Yes, the "great ride" is definitely over. The great housing market collapse has only just begun. Subprime lenders are falling like flys, and it is only a matter of time before financal failure infects the entire market.

Check out this cracking post, discussing New Century:

"After watching in disbelief how long the sub-prime ponzi scheme continued to receive the support of regulators, creditors and investors. It's amazing how rapidly New Century's house of cards has come crashing down. All at once:

Regulators are seeking to stop New Century from performing their primary business. Creditors are considering cutting off short term credit to the company. Stock Market Investors are beating the crap out of the stock. Mortgage Backed Security Investors are beating the crap out of their securitizations.

I seriously doubt NEW will survive this attack from all sides. Just as Enron and World Com crumbled when creditors pulled the plug, so too (I expect) will New Century.

Here's a post I made to the Mish board on the Motley Fool on 2/3/05 about New Century.

If you are a Fool member, the link is: http://boards.fool.com/Message.asp?mid=22012317&sort=whole#22020551

Financial Fantasy Land

I listened to the New Century Financial conference call today, and I'm convinced the executives of that company are from another planet. I think most of the analysts who called in would agree with me. They seem to be from a fantasy world where financial results according to GAAP are all that matters, and to the extent they can manipulate earnings, they are able to manipulate the truth.

When the call started, the stock was already down about 3.7%, having missed their estimates for the first time in ages. As the call went on and one amazing revelation after another came out, the stock kept dropping and now is down about 10%. Among the things that were revealed:

1. They borrow $1 Billion for 1 day every quarter so that they can show that Cash on their balance sheet.

The Billion dollars they borrow for a day is to help them "explain" their financial situation better. If they didn't borrow that money, then people might be confused and think they didn't have that much cash. As we all know, the amount of cash you own is of course equal to the amount of money people are willing to loan you. We should thank them for simplifying their accounting for us by borrowing money they don't really need right now and putting it where we can see it on their balance sheet.

2. They sell mortgages to themselves because they can report higher gains on the sales than if they sold them on the open market.

They were especially proud of becoming a REIT and all the imaginary benefits that bestowed on their results. While selling mortgages from their lending unit to their REIT unit resulted in nice gains on their income statement, the gains weren't taxable because they weren't real. Talk about the best of both worlds!

3. They aren't assuming any losses on certain portions of their loan portfolios now because most defaults occur later in the life of the loans.

The business of profiting from making bad loans depends on lending more money each and every quarter. People don't usually buy homes if they are already in deep financial trouble. It takes them awhile to get in trouble, so new loans rarely default. Therefore, new loans don't need to allow for losses because losses won't happen until the future. Since there's no guarantee there will even be a future, what's the point in allowing for such losses anyway?

4. They lowered their assumptions of future defaults which boosted earnings by 8 cents per share, and they now think $90 Million is enough reserves for future defaults on $19 Billion worth of loans.

Sure, some of their loans are delinquent, and while its nice to report late fees on these loans as profits, some allowance should probably be made for the remote possibility that there is a tiny inkling of a chance that they might lose money on these a minute faction of these loans, so it wouldn't do too much harm if they reserved a little bit of money for these loans when earnings are good. If they ever have a need, they can lower their assumptions to inflate their earnings, like they did this quarter.

What's that? All you banking analysts don't think they're setting aside enough reserves? By an order of magnitude? Well, let me assure you that their experience during the last 8 years (the greatest housing boom, HELOC expansion and cash out refinancing surge of all time) indicates that loans almost never go bad. All they have to do is rely on past results to indicate what will happen forever into the future. So obviously you are all wrong!

5. They believe that their customers can handle a 34% increase in mortgage fees on their ARMS. 20% of their loans over the past 2 quarters have been interest only, so obviously their customers understand interest. Besides, they have a lot of customers who actually have decent credit ratings. These types of people know how to budget and plan for the future.

6. They believe that housing prices can't go down by 10% and even if they do, their customers won't walk away from loans.

It's never happened before on a national level, and they say that all the talk about a housing bubble is dying down. Besides, they aren't making any more land and housing prices always go up. Plus, once customers learn to account like New Century, nobody will ever have to lose money again!

7. The compression of margins is temporary.

As rising short term rates crashed head long into falling 10-year bond rates, and as increasing competitiveness among mortgage lenders crashed head long into declining demand, margins were squeezed. But relax, this is temporary. It will only last until the weak links are squeezed out of the market. NEW tried to "lead the way" by raising rates higher, but their competitors didn't follow. When they lowered rates back down again, their competitors lowered rates further. Even though demand for loans is still slowing, and the lenders all depend on increasing originations to avoid blowing up their business models, the pressure on margins must decrease!

8. They can hedge away the risk of rising interest rates.

They buy derivatives that pay off if interest rates rise. If rates rise slowly over time, they get clobbered like CFC did. If rates rise rapidly they get to report a nice short term gain, then buy new derivatives at higher prices. If interest rates rise so quickly that their counterparties can't make their payments, then the housing market is doomed anyway, so there's no point in worrying about that single aspect of a meltdown.

In a sense, the views of the NEW executives typifies what is wrong with our entire financial system. Risk has been imagined away, and the resulting imaginary profits are taken as reality. Level upon level of creditors has leveraged themselves into the false reality that will one day come crashing down. We have:

1. Interest rates at suppressed levels because the Fed has injected record amounts of liquidity and foreign central banks have bought treasuries disproportionately to keep their currencies week, while propping up a US Government that is bound for bankruptcy.

2. We have homeowners borrowing more than they can afford at these temporarily reduced adjustable rates who are bound to default once rising payments and their inability to borrow new funds push them past the breaking point.

3. We have crazed mortgage lenders like NEW, CFC, IFC, NFI and others making bad loans at an accelerating rates to stave off the inevitable.

4. We have mutual and pension funds throwing other people's money at the crazed lenders to purchase exploding corporate bonds.

5. We have hedge funds selling derivatives to soak up interest rate risk in search of short term profits and higher NAV based fees.

In short, we have one domino after the next, all lined up ready to topple once the kindness of foreign governments runs out and the unsustainability of our twin deficits comes home to roost and the fantasy world we live in is exposed. "

The collapse of the subprime market is now gathering pace. Moreover, things are going to get much worse. The subprime mortgage market is dominated by exotic products - interest only, ARMs, no-docs. This year is when interest rate adjustments really start to kick in, and many vulnerable borrowers will start to suffer from serious cash flow difficulties. Already the default rate on subprime products is running at 13 percent. Expect that number to rise sharply, and as it goes up, it will take more and more subprime lenders down.

With perfect foresight, everyone now sees the horrible chain of events that lies before us. As the subprime market collapses, lenders stop fuelling loans to people with low credit. As these people exit the market, housing demand in the low income sector will fall off. However, the decline in prices will gradually infect the entire market. As prices come down, panic will set in. Housing equity will collapse, ending the HELOC-led consumption bubble. New home construction will fall off. This is all leading us to one place, foks - recession.

It is going to be ugly.

What do you make of this little announcement?

"Due to the current extreme market turmoil, we have temporarily suspended acceptance of loan applications in our wholesale lending division. Authorized personnel can log in below. We apologize for the inconvenience."

This is the message that confronts customers of Domestic Bank. Personally, I don't know too much about this outfit, but judging from the internet site, it looks suspiciously like another subprime lender.

Does this mean that my interest-only loan application has been turned down?

This is a somewhat surreal veiw of this week's stock market debacle. It seems like a couple of school children got hold of a cheap video-editing package and put together some charts.

1. Recently issued subprime mortgages are in a lot of trouble. For loans written in 2006 the default rates six months after mortgages were issued are two or three times higher than defaults at the same stage among loans written in 2005.

2. At least 13.5 percent of subprime borrowers were either behind on payments or in foreclosure.

3. The Federal Reserve reported yesterday that 2.11 percent of residential loans held by banks were delinquent at the end of 2006, the highest that figure has been since 2002.

4. In 2000, in the U.S., there just under $5 trillion of outstanding mortgage debt. In 2006, there was just under $10 trillion.

1