I loved the quotes in this article about the death of the subprime market - "Anything that smacks of no-income and no-documentation is history."

(CNNMoney.com) -- The subprime mortgage meltdown has been a shock to industry insiders, but now they say it's hitting harder and faster than expected - even to those who predicted the crisis in the first place.

That was the message Monday from a panel of leading industry executives on the state of the mortgage lending industry at the Mortgage Bankers Association's National Secondary Market Conference & Expo in New York.

Michael Marriott, a panelist and managing director for Credit Suisse, said, "Last October, I predicted the subprime market would collapse and many issuers would go out of business. But the violence and speed of the market sell-off surprised people."

David Lowman, a panelist and chief executive of JPMorgan Chase & Co.'s global mortgage business, said, "35 percent of what once could be done, can no longer be done," referring to mortgage loan products that have effectively been taken off the shelves.

And speaking separately from his Atlanta office, Duane LeGate, president of House Buyer Network, a specialist in short sales and foreclosure prevention, said one of the real estate agents he works with had six deals blow up within four days because, "The loan originator told him, 'We're not offering [these products] anymore.'"

According to LeGate, this kind of thing just started to happen in the past month or so. Allen Hardester, director of business development for mortgage broker Guaranteed Rate, said many once-common subprime loans products are now almost impossible to find.

"Anything that smacks of no-income and no-documentation is history," he said. "Anything above 85 percent to 90 percent loan-to-value, anything non-owner occupied, anything ludicrous as to value - like someone stepping up from a $1,000 a month payment to a $6,000 a month - is history."

Lenders are also scrutinizing applications much more carefully, and many don't like what they find. Lowman said he had recently looked at a low-document ion application for a UPS driver who earned a quarter of a million dollars last year - or so the application stated. Fictional claims, often involving outside income, are far from unusual. "If you took into account every person with a lawn care service on the side, there wouldn't be a blade of grass left in the United States," he said.

Labels:

In the midst of all this terrible news about the housing market, there is the occasional happy story of bidding wars and sellers getting more than their asking price. However, such stories should be greeted with enormous skepticism. Local newspapers have strong vested interests in the real estate market. Advertising revenues has meant that many local news outlets are so deep in the Realtors pockets that they can't see daylight.

The Washington Post is a particularly bad offender. The local housing market is deeply distressed. Yet the Post produces rubbish like the article below.

(Washington Post, May 19, 2007) He and his wife, Rebecca, wanted to sell their three-bedroom townhouse in the Del Ray neighborhood of Alexandria. They paid $430,000 in 2004. They were asking $499,000. Jim and Shane Fagan of Alexandria, shown with 19-month-old daughter Tate, recently got $16,100 more than they asked for their Del Ray townhouse. (By Katherine Frey -- The Washington Post) We were pretty apprehensive," he said. "All through the fall, we had friends in Springfield who couldn't sell their house. We watched the market. We read everything. We were hoping just to break even."

However, after just three days on the market in late March, they had five offers, one for $515,000. "This completely shocked us," he said. In a soft market portrayed so often in bleak terms for home sellers, the Casons are in a minority: sellers who get the asking price or more. Some real estate agents say that, despite key statistics that show the slowest housing market in years, they are seeing cases of multiple bids and rising prices. These seem to be concentrated in close-in neighborhoods including Del Ray, Bethesda and Chevy Chase (both sides of the Maryland-District line) and American University Park in the District.

Real estate agent Jane Fairweather of Coldwell Banker in Bethesda, who said she has had some multiple-bid sales in recent months, said sellers are adjusting prices to reflect a more reasonable market rather than the upward price spiral of previous years.

"I think the market is soft if you don't price it right," she said. "You're now seeing probably 10 to 15 percent of the sellers out there who are going to see multiple contracts.”Two years ago, it was probably 40 to 50 percent of the market that got multiple contracts. And the year before that and the year before that, 60 percent of the market got multiple contracts."

Economists in the Washington area have differing views of what this could mean. Peter Morici, an economist and business professor at the University of Maryland, sees a sign of a healthier market. "It indicates while we don't have a high-volume market, we have a market that has some stability. Fundamentally, [prices] are not a lot lower than they were at the peak," he said.

Labels:

There is one certain thing about economic forecasting; economists will be the last people to realise that there is a recession. Typically, most economists are expecting growth at around 2.5-3.0 percent this year, with some rebound next year.

However, first quarter data is at 1.3 percent, and things aren't getting better during the second quarter. If these forecasters are going to be correct, things are going to have to be very lively in the second half of this year.

WASHINGTON (Reuters) - Troubles in the U.S. housing market will weigh on economic growth this year even more than earlier estimated, according to a forecast of economists released on Monday.

Real gross domestic product, the government's broadest measure of economic output, is expected to advance 2.3 percent in 2007. That is down from an earlier estimate in February for 2.8 percent growth, a survey conducted by the National Association for Business Economics found.

The lower forecast came after the government reported anemic 1.3 percent GDP growth during the first three months of this year. "Results for the first portion of the year indicate that the expansion has descended from its cruising altitude," said Carl Tannenbaum, NABE president and chief economist at LaSalle Bank/ABN AMRO in Chicago.

However, growth in 2008 is expected to pick up to 3.1 percent after the housing market bottoms out.The survey of 48 economists taken between April 19 and May 8, found that housing market troubles, particularly those in the risky subprime mortgage lending market, will drag out through this year.

Labels:

....they first make mad.

If there is one market that should not be hiring anyone at the moment, then it is the mortgage market. However, as some firms are firing, some are hiring. Wells Fargo and Countrywide are offering jobs. Why? Because they think they can clean up as other weaker firms go under.

Perhaps someone should gently call their human resource departments and ask them to take a look at the housing sector.

(MSNBC) Subprime mortgage lending's deep freeze has sent a chill over the rest of the mortgage industry as layoffs spread to those who lend to the more creditworthy. But even as smaller players shed staff, the industry's largest players such as Wells Fargo and Countrywide Financial are stepping up their hiring as they seek to grab marketshare amid the carnage.

Wells has two dozen mortgage-related openings in the Bay Area alone. And Countrywide said it will hire 2,000 sales people this year as part of a plan to open 100 branches around the country.

But others are quietly cutting staff to cope with the slowdown as fewer mortgages are made due to tighter lending standards and fewer home sales and refinancings.

GreenPoint Mortgage, a unit of Richmond, Va.-based Capital One, laid off 70 employees, including nine at the company's Novato headquarters. About 20 percent of GreenPoint's 2,800 employees works in Marin County. The company makes so-called "Alt A" mortgages, which go to borrowers that fall between prime and subprime. A big part of GreenPoint's business is making jumbo loans, those that exceed Freddie Mac and Fannie Mae's loan limit of $417,000. Coastal California is a big market for jumbo mortgages.

Another broker hard hit by the downturn is Lending Tree, which funnels loan applications to lenders across the nation. The Charlotte, N.C., company said this month it will lay off 440 workers, or 20 percent of its staff.

Just one more sign that the rest of the world is losing faith in the dollar......

(Financial Times) Kuwait yesterday removed its currency peg to the US dollar, throwing plans for Gulf currency union by 2010 into doubt and raising the prospect that other oil-producing states might abandon long-held dollar pegs.

Sheikh Salem Abdelaziz Al Sabah, governor of the Central Bank of Kuwait, told the official Kuwait news agency the decision had been made owing to the "detrimental effects of the pegging system to the national economy".

Since late last year, Kuwaiti officials have hinted that the country would revert to a basket of currencies to prevent the sliding dollar increasing the cost of imports, which has stoked inflation to more than 4 per cent, double the historic average. This has encouraged speculators to plough billions of dollars into the dinar over the past few months, betting that the central bank would allow the dinar to appreciate.

Yesterday the dinar traded up 0.4 per cent as the central bank replaced the peg with a basket of undisclosed currencies. The central bank had allowed the currency to vary up to 3.5 per cent from the peg, but the dinar had been at the top end of the approved trading band for a year owing to the continuing weakness of the dollar and the strength of Kuwait's oil-driven economy.

The dollar is expected to make up about 75-80 per cent of the new basket, reducing the third largest Arab oil exporter's exposure to the weakening dollar.

Labels:

Lax lending standards, that is why there is a subprime crisis. Lenders ignored risks, and concentrated on increasing volumes.

(THE ORANGE COUNTY REGISTER )Just five years ago he was selling cars. Then, in January 2002, he anted up $250 for a state lender license and started selling home loans through his company, Quick Loan Funding. Over the next five years, Quick Loan wrote $3.8 billion in mortgages, lending money fast – and often on onerous terms – to people with shaky credit.

Boosted by high fees and interest rates – high even for the subprime industry – Quick Loan's after-tax profits averaged 29 percent of revenue. In 2005, Quick Loan's biggest year, profit topped $37 million. Sadek used the earnings to live the high life, buying a fleet of Ferraris, Lamborghinis and Porsches, dating a soap opera starlet and producing movies. He flew private jets to Las Vegas, where he gambled with high rollers at the Bellagio Resort.

He cultivated a rebel image, wearing a beard and hair to his shoulders, dressing in T-shirts and flip-flops, eschewing the typical mortgage banker's pinstripes. "How many thieves are wearing a suit?" he asks, sitting in the kitchen of his $4 million Newport Coast mansion.

Quick Loan Funding's name still crowns a Costa Mesa office tower. But Sadek, like the subprime lending industry, is holding a bad hand. His staff, once 700 strong, has shriveled to about 125. Monthly loan volume plunged to $30 million from a record $218 million in December 2005.

"I've sold all my cars to keep the company going," says Sadek, 38. "Every property I own is mortgaged to the max." Sadek is more than a poster child for the riches produced in the Orange County-centered subprime industry. His career arc shows how:

In California, almost anyone could open a lending business. It's harder to get a barber's license. Subprime lenders reaped billions in profits by charging high fees and interest rates. For the most part, these practices are legal. Borrowers often either misunderstood, were misinformed or simply paid no attention to the loan terms. Thousands would lose their homes.

State oversight is almost non-existent, with 58 examiners to oversee 5,000 lenders, some doing billions in business. Quick Loan has been accused of predatory lending, deceptive underwriting and fraud in at least eight lawsuits. In addition, Department of Corporations records show 33 complaints against Quick Loan, most alleging unfair business practices. Most of the lawsuits were settled out of court. And state regulators have never disciplined Quick Loan.

Sadek denies that Quick Loan ever broke the law or engaged in unfair business practices.

"I work very hard to do the best I can, to keep the mortgage company as clean as possible," he says. "Simple as that. I can't say it to you any better."

Labels:

At the height of the housing bubble, there was one thing I could not understand; "how could people convince themselves that they could afford the mortgage payments that seemed to be at least as large as their monthly incomes". It was this, more than anything, that prevented me from buying a house. I just couldn't make sense of the numbers. I would look at my paycheck and then look at the estimated mortgage costs and local taxes. It didn't add up. However, it seems that other people weren't using much arithmetic.

(SGV Tribune) Now that some of the dire fears about adjustable-rate mortgages and subprime loans are proving true, lenders and nonprofit groups are rushing to come up with ways to slow down the defaults and foreclosures. Institutions behind these assistance programs say that a lot of homebuyers were duped or deceived into signing bad loans. The main goal, they say, should be to keep people in their homes.

But there's also a growing call from mortgage brokers and other market watchers for struggling buyers to take some personal responsibility for their decisions. After all, they say, nobody forced them to sign these loans. "We're going to give somebody a crutch all because they couldn't spend a day in a seminar to find out about the loan products, and now they're saying, `Nobody told me there was education,"' said Richard Pittman, director of housing and counseling at ByDesign Financial Solutions, a credit counseling nonprofit based in Commerce.

"Come on, get your paycheck out and look at it next to your loan statement. You didn't realize the $4,000-a-month payment was going to take 92 percent of your paycheck? ... There's a point to tough love, when you say this is a learning experience."

Here is a shocking story; in Argentina, the head of the statistical service is accused of manipulating consumer price index data. It appears that the service over-estimated inflation data, thus creating higher returns for inflation-indexed government bonds.

BUENOS AIRES (Dow Jones)--An Argentine federal prosecutor has identified evidence of a violation of secrecy rules and a manipulation of consumer price data at the national statistics agency, INDEC. In a report on his findings released late Wednesday, Manuel Garrido, a prosecutor in charge of administrative investigations, said he detected the use of "devices" and "artificial elements" to create "false public information."

The report was delivered to another prosecutor, Carlos Stornelli, who is handling a case brought by opposition leaders against Commerce Secretary Guillermo Moreno for his involvement in the alleged distortions within INDEC's consumer price index measurement.

In its designated role in monitoring and maintaining a system of price accords aimed at containing an inflationary trend, Moreno has become a controversial figure in Argentina. Rumors of his resignation earlier this week prompted a brief rally in the country's bonds before these were proven to be untrue.

The former CPI director, Graciela Bevacqua, was insistent on CPI measurement methodology that would have resulted in a significantly higher January inflation reading than eventually released. Suspicions over the reliability of the monthly inflation reports have risen, causing sharp losses in Argentina's CPI-linked bonds.

The government has periodically turned the blame onto INDEC staff, accusing unnamed personnel of falsely inflating CPI data in a pact with holders of inflation-linked bonds.

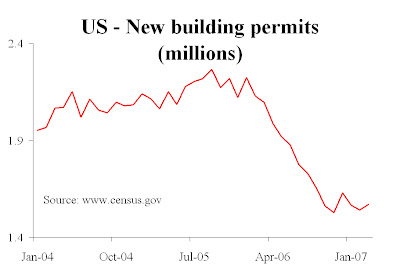

How deep is the housing crash? Data for new building permist gives us some idea. Since September 2005, permits are down 31 percent. Since new permits are a leading indicator for future housing sector developments, the short term prospects for the industry are bleak.

However, some might look at this chart and see some hope. The most recent data suggests that permits have stabilised at around 1.6 million. Time will tell whether this is the case or not, but even if permits have stablised, the industry has lost an enormous amount of activity.

Bernanke doesn't see much hope for housing. The subprime crisis is likely to weigh down the housing market right the way through 2007 until 2008. However, he doesn't think that the housing sector will have any "significant spillovers" into the real economy.

A simple re-examination of the last few years suggests that he might be wrong on that one. When the housing market was booming, it pulled the US economy up with it. Now that the housing market is sliding into a hole, there is every reason that it will take the rest of the economy with it.

May 17 (Bloomberg) -- Federal Reserve Chairman Ben S. Bernanke said a tightening in sub-prime mortgage standards will hurt the U.S. housing market and foreclosures will rise through 2008.

"Curbs on this lending are expected to be a source of some restraint on home purchases and residential investment in coming quarters," Bernanke said at a conference in Chicago today. "We are likely to see further increases in delinquencies and foreclosures this year and next as many adjustable-rate loans face interest-rate resets."

The Fed chairman maintained his forecast that the slump in housing won't have a broader impact on the economy. "We do not expect significant spillovers from the subprime market to the rest of the economy or financial system," Bernanke said.

Fed officials this year have cited the housing recession as a main risk to growth, which was the weakest in four years last quarter. Bernanke's comments today reflect the consensus of policy makers that the downturn in housing is unlikely to cause consumers to cut spending. Former Fed chief Alan Greenspan also said that subprime problems aren't spreading to lower-risk loans.

Blaming the Fed

Lawmakers and consumer advocates have blamed the Fed and other regulators for lax enforcement during the record $2.8 trillion mortgage boom between 2004 and 2006. The Fed didn't publicly rebuke any bank for failing to follow up on guidance on lending practices in the period. Regulators could have "done more sooner," Roger Cole, the Fed's chief bank supervisor told legislators in March.

Labels:

Surprisingly, the housing bubble actually reduced realtor incomes. As house prices took off into the stratosphere, far too many rookie realtors thought that the market offered an easy way to make big money. However, the laws of supply and demand are harsh and unforgiving. Soon, there were too many realtors chasing too few sales. According to the NAR’s membership profile:

As such, there are too many realtors, suffering from declining incomes in an industry in collapse.

April housing permits down; new home starts up. There is difficult choice here; which indicator more accurately reflects the true state of the housing market. The new home starts numbers are up only when compared to the previous months. Therefore, it is time to invoke the NAR excuse - the weather. Less rain in April relative to March artificially inflated the new home starts data. So don't worry folks, the housing crash continues.

NEW YORK (CNNMoney.com) -- The battered housing market got another vote of no-confidence from builders last month as applications for new projects tumbled to the lowest since 1997, even as housing starts themselves edged higher.The numbers confirm other recent reports from home builders and real estate groups of a housing market that is still searching for a bottom and that is likely to get weaker before it picks up.

Housing starts rose to an annual rate of 1.53 million in April, according to the Census Bureau report, from the revised 1.49 million pace in March. Economists surveyed by Briefing.com had forecast a slip to a 1.48 million pace in April.

But building permits, which are often seen as a measure of builder's confidence in the market, sank to an annual rate of 1.43 million in April from a revised 1.57 million in March. It was the lowest reading since June 1997. Economists had forecast a dip to 1.52 million

Labels:

We have a bubble in foreclosures. We are seeing growth rates so high, that we could be forgiven for thinking that foreclosures have "departed from fundamentals". In April, foreclosures were up a staggering 62% over the same month last year. According to RealtyTrac, a total of 147,708 home will put into foreclosure. If the housing market continues to add this number of foreclosures for 12 months, then we will see overall 1.7 million homes being dumped into an already bloated inventory of unwanted homes for sale.

Inevitably, we are forced to use similar language that was previously used to describe the housing bubble. These kind of growth rates simply cannot continue. The foreclosure rate will stabilise. We'll have a soft landing in foreclosures.

So where are the foreclosure bubble cities and states. Colorado is top of the list. Currently the state is suffereing one foreclosure filing for every 314 households. Connecticut is also making a strong showing..The state reported 4,207 foreclosure filings during the month, more than twice the national average. Other states with foreclosure rates ranking among the nations 10 highest in April were California, Ohio, Georgia, Florida, Arizona, Illinois and Michigan.

The NAR just published this quarter’s house price data. No surprises here; prices are falling; the bubble is definitively over. Here are the sorry details:

• During the first three months of this year, the nationwide median price for houses and condominiums slid 1.8 percent to $212,300.

• Prices are at a two year low.

• Over half the cities in the US experienced declines.

• Sales are down 6.6 percent compared to last year.

Just to complete the grim picture, here are a few additional numbers, which again confirm that the housing market is in the middle of a massive recession:

• The National Association of Home Builders/Wells Fargo index of sentiment fell to 30 this month from 33 in April, matching a 15-year low reached in September.

• In April, U.S. foreclosure filings jumped 62 percent compared to last year.

To summarize; prices are falling, sales are falling, and foreclosures are rising. In other words, the market is falling off a cliff.

The condo sales numbers coming out of Chicago are horrific. During the first quarter, sales of downtown condos dived 46 percent compared to the same period last year. If Chicago has another quarter like this, there won't be any sales at all.

Condos always were the most vulnerable sector of the housing market. They are particularly prone to speculative behavior. When the so-called investors took fright and disappeared, they left a massive, largely unsellable inventory behind.

Where does the Chicago condo market go from here? If the market is going to clear, prices have to fall. It is as simple and as ugly as that.

(Chicago Business News) The slide in new downtown condominium sales accelerated in the first quarter, prompting some developers to think twice about launching big new projects. Sales of new condos and townhomes in the downtown Chicago market plummeted 46% in the first quarter to 1,207 units, the lowest first-quarter total in four years. The number of new units proposed during the first quarter also fell sharply, but fears of an oversupply persist.

Buyers signed contracts for 1,207 downtown condos and townhomes in the quarter, a 46% plunge from 2,243 in the year-earlier period, according to a report by Appraisal Research Counselors, a Chicago-based real estate consulting firm. It was the seventh straight quarter of declining sales and the biggest quarterly percentage drop so far.

It seems that you can speculate on just about everything - even graves. Recently, China has been afflicted by get-rich-quick graveyard scams. Firms offered investors the opportunity to buy up lots of graves in the hope that prices would increase.

However, the grave yard bubble may be about to burst. The authorities have decided to clamp down on the cemetery speculators. Nevertheless, the grim reaper remains unperturbed. He marches on as he always did....

(BBC News) Inch for inch in China, it often costs more to be buried in a piece of land, than it does to actually live on it. So, inevitably, China has its own get-rich-quick-with-a-grave scheme.

Wang Peng is among those who have lost their life savings The idea is this - you buy up loads of empty plots, their value increases, and then you sell them off at a profit. Companies have released promotional videos promising investors a quick return on their money.

One video shows a beautiful cemetery, lined with temples. All you have to do - the company promises - is buy some empty graves, wait a while, sell them off. And make a safe and easy profit. A solid-looking deputy mayor sitting behind an equally solid looking desk is shown in one video - reassuring ordinary people that buying up stacks of graves is a good idea. But for many investors it has all gone wrong.

At his apartment in Beijing, Wang Peng searches for the certificates he has locked in a cupboard - he does not want his four-year-old granddaughter to find them and scribble on them. The certificates show that he bought 24 empty plots in a cemetery called Spiritual Spring.

These pieces of paper are all that Mr Wang has to show for his family's entire life savings - more than £10,000. But the company has never delivered. And the certificates are worthless.

"I will never forgive them," he says, "because they cheated me badly". "They made me lose all my life-savings. I am having such a difficult time right now. Why should I forgive them? "They should return our money. You can't treat us ordinary people this way."

Californian pending sales took another major hit in market. According to a new report from Hanley Wood Market intelligence, sales fell by almost 4 percent between February and March. Compared to the same month last year, pending sales are down almost 40 percent. Throughout the state in March, around 5,775 pending sales were agreed. During March last year, buyers agreed to purchase 9,160.

Could home builders be the next big bankruptcy growth industry? Some firms look vulnerable......

(yahoo news) When Kara Homes began building Horizons at Birch Hill, a community for active seniors, the plans were ambitious: 228 spacious residences that weren't typical cookie-cutter McMansions. But four years later, the project in Old Bridge, N.J., has been abandoned by Kara, which is now in Chapter 11. A dozen or so homes stand unfinished, the front doors swinging in the wind, and the half-built clubhouse bears a large "Unsafe for Human Occupancy" sign.

"It's not a great situation, but we're all hanging together," says Frank Ramson, one of the development's 70-odd homeowners. "What's killing us is the uncertainty of how long it might take another builder to step in."

Ramson isn't alone in his angst. The downturn in the housing market has caught the nation's homebuilders by surprise, leaving many overextended with costly land they can't develop and unfinished homes they can't sell. The financial strain is starting to show. From Arizona to Arkansas, dozens of small- and midsize builders have filed for bankruptcy over the past six months.

And in late April, credit analysts at Moody's Investors Service (NYSE:MCO - News) warned that a number of large homebuilders could fall out of compliance with their debt agreements later this year, leaving them at risk of default unless lenders come to their rescue by agreeing to rework their loans. Some builders are so desperate, in fact, that they're even running into the arms of hedge funds to bail them out with fresh loans at high rates and onerous terms.

More Bankruptcies?

Wall Street certainly has its concerns about the industry. This year the price of credit default swaps--in effect, a tool for bondholders to hedge their risks--has risen sharply for several large builders, including Pulte Homes (NYSE:PHM - News), Toll Brothers (NYSE:TOL - News), and D.R. Horton (NYSE:DHI - News). Toll Brothers Chief Financial Officer Joel Rassman says: "The people buying the swaps may think it's riskier, but the people actually buying our paper don't (because our spreads with Treasuries are shrinking)."

But for the industry as a whole, there may be even more problems waiting just below the surface since many builders entered into big land deals with partners, amassing billions in debt that doesn't show up on their balance sheets. "I think we're going to see a lot more (bankruptcy) filings in the next 6 to 12 months," says Tucson attorney Eric Slocum Sparks, who is representing one local builder, AmericaBuilt Construction, in Chapter 11. "I've got a couple of clients who want to see me next week, and I know these aren't social visits."

The extent of the industry's woes will depend on where housing heads from here. So far analysts and executives alike are unsure whether, or by how much, the slump will deepen. But the trends aren't pretty. The National Association of Realtors now predicts that new-home sales are likely to drop 18% this year, a bleaker scenario than the 9% decrease in the February forecast

Mortgage refinancing played a crucial role in sustaining the housing bubble. Maybe the lenders adopted some rather aggressive sales techniques. However, far too many people entered the housing market with a chain of unrealistic expectations.

The chain started with a belief that housing prices never drop. This expectation linked into the idea that interest rates would not go up significantly. These misplaced imaginings pushed borrowers into taking on too much debt to pay for overvalued houses. Interest only loans and teaser rate arms reconciled the borrower’s high levels of debt with stagnant incomes. People could only think of monthly payments, and not long term personal debt sustainability. Finally, refinancing was the last link in the chain. People stupidly thought that they could keep their monthly payments low by periodically refinancing.

It is not hard to see how many borrowers, desperate to refinance, could fall prey to unscrupolous sales pitches. “Oh yes, we can keep your interest rate at just 7 percent, so long as you sign here”. However, refinancing only makes sense as long as rates remain low. Once they rise, the chain breaks, and over-leveraged borrowers begin to understand that the level of debt and not just the monthly payments are important.

Here is a story of one lawsuit from St.Louis. The accusation has a ring of plausibility.

(STL Today, May 10th 2007) Twenty-nine families in St. Louis and four Missouri counties have filed lawsuits accusing Ameriquest Mortgage Co., a California-based mortgage lender, of engaging in abusive practices related to refinancing home loans.

The suits say that Ameriquest encouraged borrowers to refinance their loans by saying they could get better rates. When the loans were refinanced, the borrowers owed more than previously because of prepayment penalties and other fees, and their interest rates went up, not down.

The lawsuits were filed on behalf of families in the St. Louis and Kansas City areas. Four were filed Wednesday in circuit court in St. Louis, St. Louis County, St. Charles County and Jackson County, Campbell said. Another suit was filed March 30 in Jefferson County Circuit Court.

One plaintiff, Harold Bowyer of Festus, refinanced a $107,100 mortgage with a 7.7 percent interest floor and a 13.7 percent ceiling. He was told the new loan would have an interest rate of 6 or 7 percent. But after the new loan was closed, Bowyer learned that the amount he owed had risen to $122,550, including $6,519 in fees. The interest rate floor was 10.15 percent, and the ceiling was 16.15 percent, according to the lawsuit.

Labels:

Where did all this housing inventory come from? Just 18 short months ago, realtors were blathering on about the lack of supply pushing up housing prices. Today, housing inventory is exploding. Local MLS listings are bursting, and realtors are finding it difficult to keep up with the daily intake of listings from desperate sellers.

Where did all this housing inventory come from? Just 18 short months ago, realtors were blathering on about the lack of supply pushing up housing prices. Today, housing inventory is exploding. Local MLS listings are bursting, and realtors are finding it difficult to keep up with the daily intake of listings from desperate sellers.

According to ZipRealty, in April housing inventory increased by 7 percent in the nation's 18 largest metropolitan areas. Moreover, in some cities, inventory increases reached double digits; San Francisco, up 19 percent; Washington, 17 percent; Orange County, Calif., 15 percent; and Seattle, up 14 percent.

With Lereah gone, the NAR are gradually coming to terms with the new housing reality. It lowered its forecast, predicting that sales of previously occupied homes will total 6.29 million, down 2.9% from 2006.

Despite these shocking increases in inventory, prices have for the most part remained flat or have only fallen slightly. However, in the face of growing signs of market saturation, denial is no longer an option for home sellers. Without radical and desperate price reductions, inventory is going to remain high for a long time to come.

Move over Paris Hilton, say hello to Inge Bongo, the "heiress to a very rich country in central Africa". She was looking to purchase a home and VH1 following her around the upmarket estate agents in Malibu.

At least with Paris we have a fair idea where she got her money. Inge's financials are rather murky. There is a strong whiff of corruption. Nevertheless, this doesn't deter VH1 nor the realtors.

(Mail & Guardian Online , 7 May 2007) "Inge Bongo, the heiress to a very rich country in Central Africa, is in town to purchase a home. [Estate agent] Kurt Rappaport shows her a $25-million property in Malibu’s exclusive Broad Beach area, but she feels the home ‘lacks grandeur’. [Agency] co-owner Stephen Shapiro shows her a stately $25-million Beverly Hills mansion that turns out to be just what she’s looking for. Will Kurt and Stephen close the deal?"

Will they indeed? And if they do, will a part of the Gabonese government’s annual budget go towards paying for a new mansion for Inge, a daughter-in-law of Omar Bongo, the Gabonese president?

This is no joke. VH1, the music video channel, is currently airing a reality programme called Really Rich Real Estate , which features prominent and extremely wealthy people shopping for exclusive new homes in the Hollywood area.

Inge Bongo, married to Ali Ben Bongo, the Gabonese Minister of Interior and Defence and President Bongo’s son and heir apparent, is one of two people featured in the show’s opening episode. There she is, blonde, buxom and charming, floating from house to house in search of the perfect home away from home.

Much of the emphasis is on the size of the cupboards -- dressing areas really -- as Inge has a lot of clothes and even more shoes. At one stage she shows us her collection, and her favourites: "Aren’t these cute," she coos, "they have matchsticks as heels."

Another preoccupation is the "his" and "hers" bathrooms, although, Inge tells us, her husband only really needs a toilet and a newspaper. One has to wonder what VH1 was thinking when it introduced Inge Bongo as the "heiress to a very rich country in Central Africa". With a little research, they could have established that Gabon is not actually a monarchy, and Inge therefore not a princess who could "inherit" Gabon’s wealth.

VH-1 may have been confused by the fact that the Bongo family seems to treat the country like its own personal kingdom. Papa Omar has been president for 40 years and is Africa’s longest-standing head of state, his son holds two important portfolios, his daughter is his chief of staff and his son-in-law is the minister of economy and finance.

So, where did Inge get her money? Her husband is a government minister, but his official salary could not possibly cover a $25-million mansion and Inge’s lavish lifestyle. An official at the Gabonese embassy in South Africa declined to comment, on the grounds that it was a private matter.

Gabon’s ruling family has in the past been accused of looting state coffers. In 1999, the United States Senate investigated Bongo for transferring $180-million in Gabonese oil revenues to three private accounts with Citibank. Other scandals have followed, and Bongo is also believed to have used oil money to counter political opposition in recent elections. Perhaps it’s a good thing, then, that Inge already has her $25million mansion in the bag.

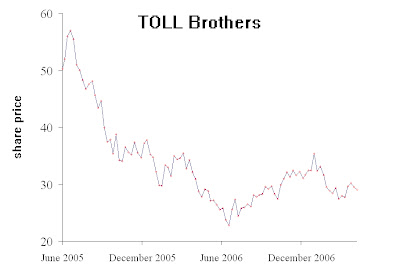

Every chart tells a story, and this one for the Toll brothers share price, tells a tale of misery. If you held the stock between June 2005 and June 2006, you would have lost around two thirds of your investment. If you had bought the share in June 2006, you would have looked good for another six months, but then TOL would have taken you for a ride down to the cleaners. Since Christmas, this stock has suffered.

Every chart tells a story, and this one for the Toll brothers share price, tells a tale of misery. If you held the stock between June 2005 and June 2006, you would have lost around two thirds of your investment. If you had bought the share in June 2006, you would have looked good for another six months, but then TOL would have taken you for a ride down to the cleaners. Since Christmas, this stock has suffered.

This blog doesn't give investment advice, it merely comments on the misery and despair that comes with holding stocks like Toll brothers. The company's recent financial statements have been high on misery index. Luxury homes are just not selling like they did back in 2005. Toll's revenues for the second quarter are down 19 percent. Furthermore, Toll now expects to take a second-quarter charge of $90 million to $130 million to cover falling home values across the country.

Here is how chief executive Bob Toll tells it: "Twenty months into this housing downturn, we continue to face difficult conditions in most of our markets," He even got a little poetic; the "lack of buyer confidence may have served to impede the glimmers of a rebound we had started to see in early February".

"Lack of buyer confidence" is an interesting statement from Bob Toll. In what exactly have the buyers lost confidence? House price inflation - that is what the buyer misses. No one believes in house price appreciation. Instead, everyone expects house prices to be lower next year. In fact, buyers are fairly confident about it.

At least Bob is not blaming the subprime debacle for Toll's miserable share performance.

After several months of improving numbers, the US external deficit is back on a downward trajectory. The deficit for March was much larger than expected; $64 billion - the highest deficit for 6 months.

After several months of improving numbers, the US external deficit is back on a downward trajectory. The deficit for March was much larger than expected; $64 billion - the highest deficit for 6 months.

The deterioration was on in the goods sector, where the deficit increased $6.0 billion from February to $70.2 billion. The services surplus was virtually unchanged at $6.3 billion. Although exports of goods increased by $1.8 billion, imports of goods increased by $7.8 billion to $160.3 billion.

According to the Commerce department, the $ 8.2 billion rise in imports was the largest dollar increase on record, while the 4.5 percent gain in imports was the largest percent change since November 2002. Higher oil prices accounted for around a quarter of that increase.

Thus, it would appear that despite the slowing economy, the US consumer is undeterred. We just keep on buying. However, here is the thing; if the economy is slowing, unemployment rising and wage growth moderating, how is the consumer financing all this additional buying?

Today, RealtyTrac published the latest data on nationwide foreclosures. The numbers are bad:

Foreclosure activity in some states has reached epidemic levels.

Labels:

In the run-up to this week's FOMC meeting, several commentators have suggested that the Fed may be delaying a necessary cut in interest rates. The story goes something like this; recent data tells us that economy is slowing rapidly, whilst inflationary pressure is subsiding, and if the Fed doesn't do something soon, then the economy will slip into a nasty recession by the end of the year.

The problem at the story is that it's only half true. Certainly, the economy is slowing, but inflationary pressures remain rather strong. Just take a look at gas prices if you own any doubt about that. The consumer still keeps on consuming, as the chart above suggests. There is a slight post-holiday dip consumption,but by March everything is back to normal. Certainly, the housing market is looking into the abyss, but the stock market is doing fine, so the overall effect on wealth is redistributive, rather than a growth reducing.

However, if you think about a little further, you will realise that it is consumer spending that is the problem, not inflation. There is a nasty story behind that retail sales chart. It is a story of declining personal savings. Low interest rates have discouraged savings, and encouraged consumption, which in turn has been fuelled by an accumulation of private-sector debt. The counterpart of this declining savings rate is found in the US current account. The federal government has also done its part to accumulate a large stock of debt. For several years, the government has run large fiscal deficits, financed by treasury bills, largely bought by foreigners.

Private and public sector balance sheets need to recover, which is just a fancy way of saying that people need to save more and the government should reduce spending. The only thing that will make people save more is a higher return on their savings. This is why the Fed needs to raise rates, and at a minimum, keep them at the current level for the foreseeable future.

What would happen if the Fed decided to cut rates prematurely as some would suggest? Simply, the consumer would keep on doing what she has done the last five or six years. She would keep on borrowing, keep on spending, and keep on building up debt. The US current account will continue to be high. In the short term, foreign central banks will keep financing that deficit, until one day they will have had enough, and suddenly start selling dollars. At this point, the current account will adjust very rapidly indeed, and the US economy could sink into a calamitous recession.

Currently, the economy is slowing, but that is a good thing. It is better to have a gradual slowdown in growth, coupled with an orderly repair of private balance sheets, rather an a disorderly financial crisis. Let's hope that the Fed ignores these shortsighted calls for a cut in interest rates.

Here is another shocker - 8 out of 10 subprime loans have variable interest rates. Sit back in your chair and think about that one for a moment. Lets repeat; eight out of ten loans given to people with bad credit will shortly reset to higher rates. This means just one thing; the US housing market is sitting on a foreclosure time bomb.

May 7 (Bloomberg) -- U.S. homeowners entered the foreclosure process in April at more than double the rate of a year ago as tightening credit made it more difficult to refinance and a swelling supply of unsold homes made it tough to sell.

The number of homeowners in all three phases of foreclosure rose last month over the same period a year ago, according to Sacramento-based Foreclosures.com, which gathers data from county courthouses nationwide. Those receiving their first notice of foreclosure from a bank climbed 127 percent, those with homes going up for sale by auction jumped 164 percent and those whose homes were repossessed by banks went up 40 percent.

Eight of 10 subprime loans, given to borrowers with bad or limited credit histories, adjust over time to higher interest rates and many homeowners can no longer afford their mortgages. With existing home sales at a four-year low, it's more difficult to sell because there are so many homes on the market.

Banking is a simple business; you take deposits, and you extend loans. So long as your loans are good, and your interest rates competitive, people are generally happy depositing money in your bank. However, competitive interest rates often means that profitability in the banking sector is quite low. Banks can only increase profitability by increasing volumes, which means taking on riskier loans. It is a strategy that has the potential to send a bank into bankruptcy. When a bank increases its lending volumes, it does so by reducing lending standards. It spends less time checking on the credit worthiness of its borrowers.

Now the New Century Financial is bankrupt, the true story of its extraordinary growth is coming to light. Guess what; it is a textbook case of a bank gone bad. Management focused on volumes and not on asset quality. Loan appraisers were told to ignore the risks from clients with dubious credit histories, and issue the loans. Inevitably, New Century Financial ended up with a loan portfolio riddled with defaults and foreclosures. Once this fact became public knowledge, the companies' financiers pulled the plug, and took away their deposits.

In today's Washington Post, a loan appraiser tells the hair raising story of what went on inside the company. The lesson is a simple one, if the lender doesn't allow it appraiser is to assess risks, the lender will end up with a lending book full of bad loans, and it will go bust.

The New Century saga raises very difficult questions for the Financial Sector Regulator, who was supposed to oversee and prevent lenders from behaving like this. After all, it is not the first time that the US has suffered from failed banks. So what exactly were they doing when New Century middle management were walking around with baseball bats intimidating loan appraisers?

(Washington Post) Maggie Hardiman cringed as she heard the salesmen knocking the sides of desks with a baseball bat as they walked through her office. Bang! Bang! " 'You cut my [expletive] deal!' " she recalls one man yelling at her. " 'You can't do that.' “Bang! The bat whacked the top of her desk. As an appraiser for a company called New Century Financial, Hardiman was supposed to weed out bad mortgage applications. Most of the mortgage applications Hardiman reviewed had problems, she said.

But "you didn't want to turn away a loan because all hell would break loose," she recounted in interviews. When she did, her bosses often overruled her and found another appraiser to sign off on it. Hardiman's account is one of several from former employees of New Century that shed fresh light on an unfolding disaster in the mortgage industry, one that could cost as many as 2 million American families their homes and threatens to spill over into the broader economy. New Century has become the premier example of a group of companies that grew rapidly during the housing boom, selling working-class Americans with questionable credit huge numbers of "subprime" loans with "teaser" rates that typically rose after the first two years. This business transformed the once-tiny New Century into a lending powerhouse that was held up as a model of the mortgage industry's success.

Labels:

Hovnanian Enterprises - the new home builders - announced another quarter of dreadful numbers. Second quarter loses could be as high as $0.30 a share, far worse that the company's original suggestion of a $0.05-0.20 per share loss. Furthermore, the company also expects to take a $15-20 million hit on abandoning deposits on land it would not develop. Overall, their losses could be as high as $0.45 to $0.50 per share.

Hovnanian Enterprises - the new home builders - announced another quarter of dreadful numbers. Second quarter loses could be as high as $0.30 a share, far worse that the company's original suggestion of a $0.05-0.20 per share loss. Furthermore, the company also expects to take a $15-20 million hit on abandoning deposits on land it would not develop. Overall, their losses could be as high as $0.45 to $0.50 per share.

The company trotted out the housing sector's excuse of the moment - the subprime market, announcing that "The adverse publicity surrounding the subprime market has further damaged homebuyers' psychology, resulting in decreased demand and leading to continued use of sales incentives." However, Hovnanian were hardly catering for the subprime client. Nevertheless, the subprime crash is the housing equivalent of the black death; it kills everything it touches.

Sales performance was awful. Hovnanian delivered just 3,196 homes, down from 4,555 last year. However, the company had some limited success in reducing cancellations which fell from 36% to 32% compared to the last quarter of 2004. Looking forward, things look bad, with net contracts were down 21% to 3,116.

Hovnanian share prices are down a shocking 67 percent since their peak in the summer of 2005. Who would have known back then that housing construction shares would have been such a bad investment? Actually, anyone who had bothered to think about the bloated housing bubble. It was obvious that it couldn't go on and that Hovnanian Enterprises would be an early victim.

Here are the five housing data trends that you need to know:

1. Housing construction has slumped. - New-home construction starts dropped 14.3 percent from December to January, putting them 37.8 percent below the same time a year earlier. Building permits dropped 28.6 percent from a year ago.

2. Sales volumes are down. - Last month's sales of existing homes were down 4.3 percent from January 2006. There are about 1 million homes on the market.

3. Home builders can't shift their inventory. - Between January 2006 and January 2007, new home sales dropped 20 percent, according to the Commerce Department.

4. Risk premia (i.e. long term mortgage rates) are rising. - The National Association of Realtors predicts the cost of a 30-year fixed mortgage will jump to about 6.6% by the end of the year.

5. Mortgage resets will accelerate.- Of the $8 trillion to $9 trillion in mortgage debt outstanding in the country, a half-trillion dollars' worth is about to be converted to higher interest rates now that introductory teaser periods are expiring

Labels:

It was long speculated that California would be the epicentre of the housing crash. So far, it hasn't disappointed. California was the nation's leader in exotic, strange, and default prone mortgage products. Now, in one Californian city after another, the local press are reporting an explosion in defaults and foreclosures.

San Diego is one such city.......

In the fourth quarter of 2006, San Diego County experienced a 169 percent increase in homes receiving notices of loan default from a year ago. Default notices the first step in the foreclosure process - were up to 3,150 from 1,173 for the like quarter 2005, according to DataQuick Information Systems, which compiles home property data.

Throughout California, there were 37,273 default notices - notifying homeowners 90 days behind on payments sent from October to December 2006, marking the most foreclosure activity since the third quarter of 1998, when the number of default notices hit 38,053.

The study, released in January, states that foreclosures tend to occur a year or two after the loan is made. Most of the loans currently entering default originated between January 2005 and February 2006. After the first year or two, many home buyers who took out adjustable rate mortgages and other "inventive loans" experienced the "reset" of their payments; when a buyer's introductory interest rate shifts, and monthly payments increase.

Labels:

Check this link out from the Minneapolis Star Tribune see the extent of foreclosures in the city. It contains an extraordinary graph illustrating the housing disaster in the city. Since January 2006, over 2,500 homes have been sold in foreclosure sales.

This article reports that there "have been 1,400 foreclosure sales in North Minneapolis since January 2006. This is an area of less than 9 square miles that contains 12,810 single family residences. Meaning: 10.9% of the houses in North Minneapolis have already gone through a foreclosure sale since the real estate collapse began."

One house in ten? This has got to be a national record. Is there anywhere in the US with a higher foreclosure rate?

In the city after city, the story is the same. The story starts back in 2002, with a massive cut in interest rates prompt an undeserved rise in house prices. With increased housing demand comes a construction boom, and speculators taking a bet on house prices rising further.

It is now spring 2007 and the story is reaching a sorry conclusion; interest rates are up , speculators have long ago disappeared, the construction boom is replaced with recession, and prices are crashing. Everywhere, there is oversupply in the housing market.

However, it is dangerous to think that it is safe to return to the housing market, as this story from Tucson Arizona warns:

(Arizona Daily Star) Tempted by a generous price cut, Cynthia Saenz couldn't resist buying a new house in Vail about eight months ago. But after reaping benefits on the buyers' side of the market, Saenz is languishing on the sellers' side. She put her Southeast Side house up for sale five months ago and has reduced the 1,800-square-foot home's price from $230,000 to $200,000. Still, it hasn't sold. Saenz's house is among a record number of properties on the market in the Tucson area.

An explosion of home-building and numerous condo conversions during the boom of a few years ago have led to an unprecedented glut of homes now that the market has cooled, according to real estate executives and industry analysts. Investors who helped propel the boom are dumping properties and going elsewhere, they said. Many homes are being sold only with the help of price reductions and incentives.

Several industry observers predict the market will pick up within a year. But their hopes all hinge on whether the overabundance of homes can be reduced.

This is where it started, with phonecalls just like this....

This video clip began circulating last June. It shows a mortgage broker trying to close a three year ARM over the phone. The clip reeks of cynicism, as the broker tries to get the client to refinance their mortgage. His associate, who is out of camera shot, is heard saying " say don't worry", as if this is all that is necessary to finally close a deal. The irony, however, is is that anyone holding an ARM has quite a lot of worry about. As the fixed interest rates expire, mortgage repayments are going through the roof, and pushing many vulnerable home-owners into foreclosure.

Just how unbalanced is trade between the US and China?

Just how unbalanced is trade between the US and China?

Back in 1985, bilateral US-Chinese trade was in balance. The US exported to China about as much as China exported to the US. Since then, however, the US has sucked up Chinese imports. Last year, the US imported almost $290 billion of goods, but exported just $55 billion.

Last year, the US ran up a $818 billion trade deficit. Around a third of that deficit was due to trade with China. Overall, the bilateral US-China trade deficit is running at about 2 percent of GDP a year.

So how do the Chinese manage to out-trade the US? China tightly pegs its currency's value to that of the dollar at an an extremely low rate. This low rate means that Chinese goods are very price competitive and this encourages a large bilateral surplus with the United States. This policy, in effect, offers a massive subsidy to exports. However, the Chinese need to purchase huge amounts of US assets by printing local currency. In 2006 alone, the Chinese central bank purchased around $200 billion in U.S. Treasury Bills and other securities. Currently, the Chinese are sitting on $1.2 trillion of foreign exchange reserves.

However, the Chinese can't keep on subsidizing exports in this manner. It is bad for poor Chinese workers, who are effectively subsidizing rich US consumers. It is bad for the US economy, which is building up huge liabilities with China.

The solution is simple enough. China must let the Yuan appreciate. American exports with China can begin to recover, while Chinese workers can begin to see real increases in their standard of living. However, the Chinese government seem addicted to this "export-at-all-costs" development strategy.

Labels:

Living in the city can be expensive. Over the last four years, the inflation rate in America's largest cities has been significantly faster than for the US as a whole. Cumulatively, LA has experienced 3 percentage points of additional inflation relative to the rest of the country. In Chicago, the situation is even worse; the city has accumulated at least 4.5 percentage points of inflation.

Living in the city can be expensive. Over the last four years, the inflation rate in America's largest cities has been significantly faster than for the US as a whole. Cumulatively, LA has experienced 3 percentage points of additional inflation relative to the rest of the country. In Chicago, the situation is even worse; the city has accumulated at least 4.5 percentage points of inflation.

Taking this unlikely scenario a stage further, suppose that you won a massive payout. What do you then do with the money? Well, putting it in a broadly based set of mutual funds wouldn't be such a bad idea. Alternatively, you could go down to an investment advisor and see the money invested in loser tech stocks. This is exactly what happened to one lottery winner from Milwaukee. Moreover, it is common for lottery winners to blow their ill-deserved winnings on poor investments. Read on....

"From $5.5 million to living on a pension

On the day he rode home in a limousine from his security-guard job 12 years ago with a winning $5.5 million lottery ticket in his hand, Andrew Cicero of Muskego figured he had it made. But he finds himself now in far different straits than he imagined when he accepted a giant Wisconsin Megabucks novelty check.

Cicero, 72, has sold his Waukesha County house and lives in a Milwaukee apartment on a pension and Social Security income while he takes an investment counselor to arbitration. This month, he sued a Milwaukee accounting firm over tax advice he claims cost him at least $170,000.

His fiscal downfall followed what has emerged as something of a pattern among lottery winners nationally: Someone with little training in dealing with vast sums of money gets a sudden windfall, only to see it tumble maddeningly into the wind.

Court and arbitration documents tell part of Cicero's story. Under the state's rules at the time, the $5.5 million prize he won in 1995 was to be paid out as 25 annual payments that would start at $98,000 and increase each year. But by 2000, he decided on a different approach: sell the future annual payments off to a private firm for an immediate lump sum - in his case, about $2 million - that he could roll into investments. He'd just live off the earnings and interest.

He alleges that within a few months, the Smith-Barney advisers had 98 percent of his money invested in individual stocks, substantially technology companies. The year was 2000, which would prove a spectacularly bad time to sink one's entire fortune into tech stocks. Cicero's lawyer has alleged the advisers were "breathtakingly irresponsible" to put a lottery winner's windfall wholly into individual stocks. The court and financial-arbitration filings tell the story in flat terms, claiming Cicero lost $600,000 or more in bad investments. And he ended up paying $240,000 more to the IRS for penalties and interest after he learned the hard way that a lump-sum lottery buyout doesn't count as capital-gains income."

The US economy is slowing down. Job growth data fell to its lowest level in two years. According to the Labor deparment, the economy added just 88,000 jobs, while the unemployment rate rose 0.1 percent to 4.5 percent.

The building sector lost 11,000 as new home construction slowed. Retailers are also having a hard time, losing 26,000 jobs. Manufacturers' payrolls shrank by 19,000 in March after declining by 18,000 a month earlier. The slowdown was also evident in the average number of hours worked, which decreased to 41.1 hours. Meanwhile, average overtime declined from 4.3 to 4.2 hours.

So the US economy is on track for an end-of-year recession. The housing market is leading the way, the US consumer is exhausted, and government debt is rising. Yet the Fed will find it hard to cut rates, inflationary pressures remain stubbornly strong. Any interest rate cuts will put further downward pressure on the dollar, which will push import prices up. Only two questions remain; how long and how deep.

Its getting real ugly in Sacramento. Median home values crashed 7.4 percent during the first quarter from a year ago. For all the gory details, check out that great blog Sacramento Landing.

Labels:

GMAC - the financial services wing of General Motors - have just reported a huge drop in profits. Again, the subprime market is to blame.

"The slump in the US property market has hit General Motors hard, with first-quarter profits dropping 90 per cent as losses at its mortgage lending business offset improved sales of cars.

Profits of $62 million (£31 million) at the world's second-largest carmaker for the first three months of the year were sharply down from $602 million in the same period a year earlier.

The company attributed the decline to a $305 million loss by GMAC Financial Services, compared with a profit of $495 million a year earlier. The main factor behind the deficit was the fallout from a collapse in the US sub-prime mortgage market.

GM sold a 51 per cent stake in GMAC to private equity investors last year, but still owns 49 per cent of the business. The group said in a statement: “The decline in reported GM earnings is more than accounted for by losses in the residential mortgage business of GMAC Financial Services (GMAC), driven by continued weakness in the US non-prime mortgage sector.”

Labels:

Here are two ads that illustrate all that is wrong with today's housing industry. The first is a vile and offensive realtor ad from Colorado.

I think we can all agree that getting a young woman to take off her top doesn't say much for the sales ability of a realtor. Hat tip to real estate video for finding this piece of crap.

The second ad comes from Lou Minatti. This radio add pushes one of those real estate investment seminars. "Turn $500 of investment income into $3,000 of cashflow". It is a deeply misleading advert, largely aimed at the Casey Serin wannabees.

Labels:

Bernanke might be talking tough on interest rates, but many investment analysists are far fron convinced. Many believe that the collapsing housing market will bring the economy down with it, pushing the US into recession by the end of the year and reducing inflationary pressure. Rather than raising interest rates, the Fed will be beginning a new cyle of monetary policy easing.

Notwithstanding what the investment bankers might be saying, inflationary pressures remain strong. In February, the Fed's preferred measure of inflation - the price index for consumer spending on items excluding food and energy - rose 0.3 percent. The price gauge rose 2.3 percent from a year earlier; significantly above the Fed's comfort level of 1 percent to 2 percent.

April 30 (Bloomberg) -- Federal Reserve Chairman Ben S. Bernanke's assertion that interest rates may need to increase to curb inflation is wrong. That's what Goldman Sachs Group Inc., Merrill Lynch & Co. and UBS AG are saying.

While Bernanke warned last month that the odds of worsening inflation have increased, chief economists at the three firms say the worst housing slump in a decade may drive the U.S. economy into a recession and stifle consumer prices. Their chief economists say the Fed will cut its target for overnight loans between banks at least three times this year.

The conflict boils down to opposing views about real estate. Central bank governors found no evidence that the housing market had affected the broader economy, according to notes of their March policy meeting, released April 11. The National Association of Realtors said last week existing home sales fell 8.4 percent in March, the steepest drop since 1989.

Bernanke is missing "the linkage between residential housing investment and the broader economy," Jan Hatzius, chief U.S. economist at New York-based Goldman, the world's most profitable securities firm, said in an interview. "The housing downturn is of the first order of importance." Hatzius says the Fed will cut rates three times this year, to 4.5 percent from 5.25 percent.

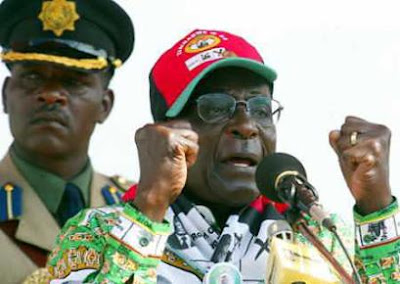

The Zimbabwean despot – Robert Mugabe – is on the verge of scoring a major diplomatic coup. Zimbabwe looks certain to become chair of the United Nation’s Commission on Sustainable Development. So what exactly qualifies Mugabe to take the leadership of this UN body?

Mugabe’s record on sustainable economic development is unique. Few dictators have destroyed a country’s economy more quickly or more completely. Between 2000 and 2007, the national economy contracted by as much as 40 percent. Zimbabwe has the highest inflation rate in the world; prices are increasing at over 2,200 percent a year. Zimbabwe suffers from persistent shortages of foreign exchange, fuel, and food. Under Mugabe’s mis-rule, Zimbabwe has become the second most heavily indebted country in the world.

Despite his socialist rhetoric, Mugabe has created one of the most unequal societies in the world. The lowest 10 percent of Zimbabwe's population consume only 2 percent of income while the highest 10 percent consume 41 percent. Both unemployment and poverty rates are running at nearly 80 percent of the population.

Mugabe turned Zimbabwe from being the breadbasket of southern Africa to an importer of food. His chaotic land redistribution campaign, which began in 2000, caused an mass exodus of white farmers. As he handed land over to his cronies, the economy collapsed, and ushered in widespread shortages of basic commodities, and pushed the population to the edge of famine.

His human rights record is appalling. In April 2005, his corrupt administration began “Operation Restore Order”. Using the pretext of an an urban rationalization program, his thugs destroyed the homes or businesses of 700,000 mostly poor supporters of the opposition,

Mugabe will use the leadership of the UN sustainable development committee as a platform to attack the developed world. He will peddle his usual conspiracy theories where Zimbabwe is presented as the victim of hostile western government. In the process, he will further discredit the UN and its institutions. However, the UN can hardly complain. If it is prepared to accept countries like Zimbabwe in leadership roles of the key UN institutions, ridicule and comtempt is inevitable.

Labels:

San Francisco home sellers think that the housing crash has reached the bottom. After falling sharply during the latter half of last year, median asking prices have stabilised. Since December, sellers have refused to cut prices. However, inventory isn't playing fair. As soon as asking prices stabiised, inventory began to rise.

San Francisco home sellers think that the housing crash has reached the bottom. After falling sharply during the latter half of last year, median asking prices have stabilised. Since December, sellers have refused to cut prices. However, inventory isn't playing fair. As soon as asking prices stabiised, inventory began to rise.

Only a further round of heavy price discounts will reduce inventory. The San Francisco housing crash continues.....

Data provided by the housingtracker website.

Can we have just one day without some bad news from the America's housing sector. Of course not.

Today, we have the index of pending sales of existing homes. In March, the index fell to its lowest level in four years in March. According to the NAR, the index of signed purchase agreements, or pending home resales, fell 4.9 percent to 104.3, the lowest since March 2003.

The crash continues......

It an old trick played by all dictators - demonize the foreigner. Today, Chavez - the cracker from Caracas - effectively stole a large chunk of the country's oil sector, under the pretext of protecting Venezuela's national assets.

It an old trick played by all dictators - demonize the foreigner. Today, Chavez - the cracker from Caracas - effectively stole a large chunk of the country's oil sector, under the pretext of protecting Venezuela's national assets.

U.S. companies ConocoPhillips, Chevron, Exxon Mobil, Britain's BP, Norway's Statoil and France's Total woke up today to find that their assets had been expropriated. After years of careful private sector development of the oil industry, which benefited both Venezuela and investors alike, Chavez comes along with that well-worn old song about "Homeland, Socialism or Death." What a sad choice to put before the nation. Would not "protection of property rights, democracy, and peace" be a better maxim?

With the benefit of high oil prices, Chavez can afford to offend foreign investors. However, once investors are expropriated, it is hard to convince them to return. Venezuela is a one industry country. It has a long and miserable history of boom following bust as oil prices rise and fall. Without foreign investment, the country's dependence on oil will increase. In the long run, Venezuela's development is jeopardized for the sake of crude quasi-racist anti-Americanism.

Foreign investors brought development, international best practice and technology transfer to Venezuela. Certainly, Venezuela has a sorry record of neglecting the poor. However, that was the responsibility of successive Venezuelan governments, who found it convenient to export responsibility for their failure overseas. Of course, it is always easier to blame Uncle Sam rather than undertake sustainable political and economic reform.

Venezuela's state oil company PDVSA has a well-earned reputation for corruption and mismanagement. Now, the PDVSA's management has even more assets to mismanage. Give PDVSA a little time and it is certain to screw things up. As the current management pulls out, these companies will run into production and safety problems.

Chavez now intends to nationalize the utilities and telecommunications. In the fullness of time, he will propose economic centralization and 5 year plans. Once oil prices fall, financial difficulties will follow. Venezuelans will see Chavez for what he is - a political fraud. One day, he will be racing to the airport, fleeing into exile. It is what usually happens to South American dictators.

Personally, I always thought that Kiyosaki had nothing useful to say. Happily I haven't bought one of his books, though I did quickly skim-read one while having a coffee at Barnes and Noble. His investment approach could best be summarized as contempt for his loving father plus a belief in real estate. He also used that real estate victim- Casey Serin - cynically as a self promotion vehicle. It was unforgivable but unsurprising.

Read the article, laugh and seek out the weak investment disclaimer.

Labels:

3